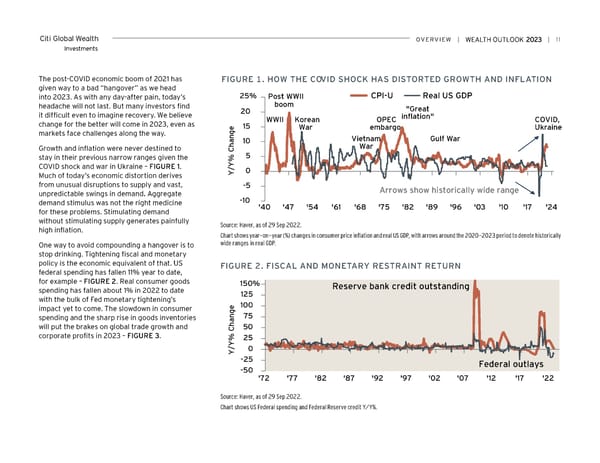

Citi Global Wealth overview | | 11 Investments The post-COVID economic boom of 2021 has FiGUre 1. How THe Cov iD SHoCK HAS DiSTorTeD GrowTH AND iNFLATioN given way to a bad “hangover” as we head into 2023. As with any day-after pain, today’s 25% Post WWII CPI-U Real US GDP headache will not last. But many investors find boom it difficult even to imagine recovery. We believe 20 "Great inflation" change for the better will come in 2023, even as 15 WWII Korean OPEC COVID, e War embargo Ukraine markets face challenges along the way. g n a 10 Vietnam Gulf War Growth and inflation were never destined to Ch War 5 stay in their previous narrow ranges given the % COVID shock and war in Ukraine – FIGURE 1. /Y 0 Much of today’s economic distortion derives Y from unusual disruptions to supply and vast, -5 unpredictable swings in demand. Aggregate Arrows show historically wide range demand stimulus was not the right medicine -10 for these problems. Stimulating demand '40 '47 '54 '61 '68 '75 '82 '89 '96 '03 '10 '17 '24 without stimulating supply generates painfully Source: Haver, as of 29 Sep 2022. high inflation. Chart shows year-on-year (%) changes in consumer price inflation and real US GDP, with arrows around the 2020-2023 period to denote historically One way to avoid compounding a hangover is to wide ranges in real GDP. stop drinking. Tightening fiscal and monetary policy is the economic equivalent of that. US FiGUre 2. FiSCAL AND MoNeTArY reSTrAiNT reTUrN federal spending has fallen 11% year to date, for example – FIGURE 2. Real consumer goods 150% spending has fallen about 1% in 2022 to date Reserve bank credit outstanding with the bulk of Fed monetary tightening’s 125 impact yet to come. The slowdown in consumer e 100 g spending and the sharp rise in goods inventories n 75 a will put the brakes on global trade growth and Ch50 corporate profits in 2023 – FIGURE 3. % 25 /Y 0 Y -25 -50 Federal outlays '72 '77 '82 '87 '92 '97 '02 '07 '12 '17 '22 Source: Haver, as of 29 Sep 2022. Chart shows US Federal spending and Federal Reserve credit Y/Y%.

Citi Wealth Outlook 2023 Page 10 Page 12

Citi Wealth Outlook 2023 Page 10 Page 12