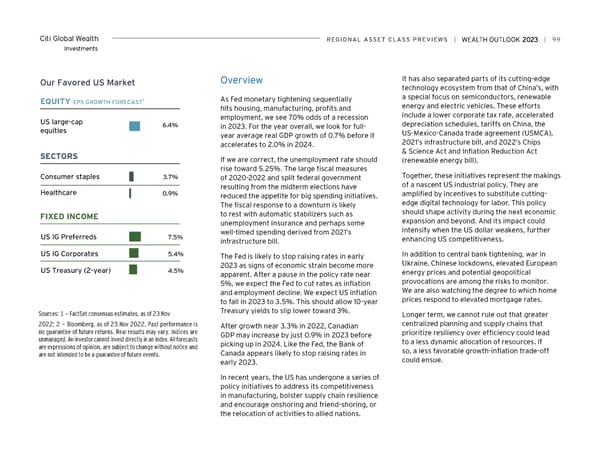

Citi Global Wealth reGioNAL ASSeT CLASS PreviewS | | 99 Investments Our Favored US Market Overview It has also separated parts of its cutting-edge technology ecosystem from that of China’s, with EQUITY 1 As Fed monetary tightening sequentially a special focus on semiconductors, renewable EPS GROWTH FORECAST energy and electric vehicles. These efforts hits housing, manufacturing, profits and employment, we see 70% odds of a recession include a lower corporate tax rate, accelerated US large-cap 6.4% in 2023. For the year overall, we look for full- depreciation schedules, tariffs on China, the equities year average real GDP growth of 0.7% before it US-Mexico-Canada trade agreement (USMCA), accelerates to 2.0% in 2024. 2021’s infrastructure bill, and 2022’s Chips SECTORS & Science Act and Inflation Reduction Act If we are correct, the unemployment rate should (renewable energy bill). rise toward 5.25%. The large fiscal measures Consumer staples 3.7% of 2020-2022 and split federal government Together, these initiatives represent the makings resulting from the midterm elections have of a nascent US industrial policy. They are Healthcare 0.9% reduced the appetite for big spending initiatives. amplified by incentives to substitute cutting- The fiscal response to a downturn is likely edge digital technology for labor. This policy FIXED INCOME to rest with automatic stabilizers such as should shape activity during the next economic unemployment insurance and perhaps some expansion and beyond. And its impact could well-timed spending derived from 2021’s intensify when the US dollar weakens, further US IG Preferreds 7.5% infrastructure bill. enhancing US competitiveness. US IG Corporates 5.4% The Fed is likely to stop raising rates in early In addition to central bank tightening, war in 2023 as signs of economic strain become more Ukraine, Chinese lockdowns, elevated European US Treasury (2-year) 4.5% apparent. After a pause in the policy rate near energy prices and potential geopolitical 5%, we expect the Fed to cut rates as inflation provocations are among the risks to monitor. and employment decline. We expect US inflation We are also watching the degree to which home to fall in 2023 to 3.5%. This should allow 10-year prices respond to elevated mortgage rates. Sources: 1 - FactSet consensus estimates, as of 23 Nov Treasury yields to slip lower toward 3%. Longer term, we cannot rule out that greater 2022; 2 - Bloomberg, as of 23 Nov 2022. Past performance is After growth near 3.3% in 2022, Canadian centralized planning and supply chains that no guarantee of future returns. Real results may vary. Indices are GDP may increase by just 0.9% in 2023 before prioritize resiliency over efficiency could lead unmanaged. An investor cannot invest directly in an index. All forecasts picking up in 2024. Like the Fed, the Bank of to a less dynamic allocation of resources. If are expressions of opinion, are subject to change without notice and so, a less favorable growth-inflation trade-off are not intended to be a guarantee of future events. Canada appears likely to stop raising rates in early 2023. could ensue. In recent years, the US has undergone a series of policy initiatives to address its competitiveness in manufacturing, bolster supply chain resilience and encourage onshoring and friend-shoring, or the relocation of activities to allied nations.

Citi Wealth Outlook 2023 Page 98 Page 100

Citi Wealth Outlook 2023 Page 98 Page 100