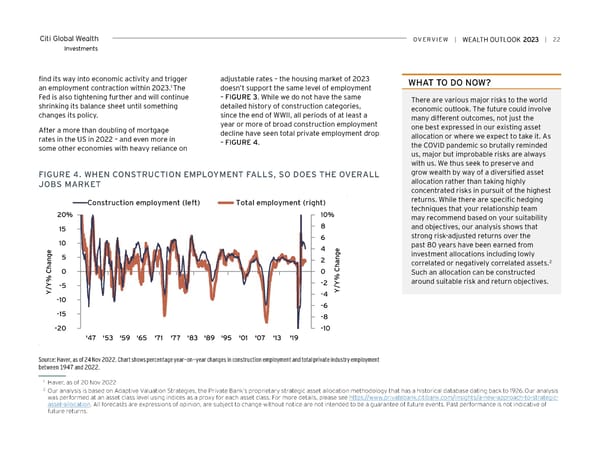

Citi Global Wealth overview | | 22 Investments find its way into economic activity and trigger adjustable rates – the housing market of 2023 wHAT To Do Now? 1 an employment contraction within 2023. The doesn’t support the same level of employment – Fed is also tightening further and will continue FIGURE 3. While we do not have the same There are various major risks to the world shrinking its balance sheet until something detailed history of construction categories, economic outlook. The future could involve changes its policy. since the end of WWII, all periods of at least a many different outcomes, not just the year or more of broad construction employment one best expressed in our existing asset After a more than doubling of mortgage decline have seen total private employment drop allocation or where we expect to take it. As rates in the US in 2022 – and even more in – FIGURE 4. the COVID pandemic so brutally reminded some other economies with heavy reliance on us, major but improbable risks are always with us. We thus seek to preserve and FiGUre 4. wHeN CoNSTrUCTioN eMPLoYMeNT FALLS, So DoeS THe overALL grow wealth by way of a diversified asset JoBS MArKeT allocation rather than taking highly concentrated risks in pursuit of the highest Construction employment (left) Total employment (right) returns. While there are specific hedging techniques that your relationship team 20% 10% may recommend based on your suitability 15 8 and objectives, our analysis shows that 6 strong risk-adjusted returns over the 10 past 80 years have been earned from e 4 e g 5 g investment allocations including lowly n 2 n a a correlated or negatively correlated assets.2 Ch Ch 0 0 Such an allocation can be constructed % % around suitable risk and return objectives. /Y -5 -2 /Y Y -4 Y -10 -6 -15 -8 -20 -10 '47 '53 '59 '65 '71 '77 '83 '89 '95 '01 '07 '13 '19 Source: Haver, as of 24 Nov 2022. Chart shows percentage year-on-year changes in construction employment and total private industry employment between 1947 and 2022. 1 Haver, as of 20 Nov 2022 2 Our analysis is based on Adaptive Valuation Strategies, the Private Bank’s proprietary strategic asset allocation methodology that has a historical database dating back to 1926. Our analysis was performed at an asset class level using indices as a proxy for each asset class. For more details, please see https://www.privatebank.citibank.com/insights/a-new-approach-to-strategic- asset-allocation. All forecasts are expressions of opinion, are subject to change without notice are not intended to be a guarantee of future events. Past performance is not indicative of future returns.

Citi Wealth Outlook 2023 Page 21 Page 23

Citi Wealth Outlook 2023 Page 21 Page 23