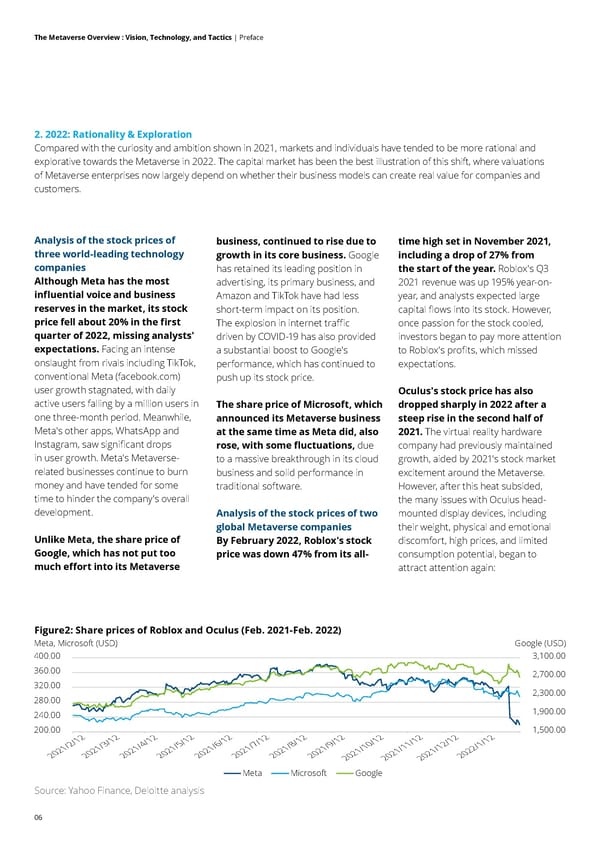

06 The Metaverse Overview : Vision, Technology, and Tactics | Preface 2. 2022: Rationality & Exploration Compared with the curiosity and ambition shown in 2021, markets and individuals have tended to be more rational and explorative towards the Metaverse in 2022. The capital market has been the best illustration of this shift, where valuations of Metaverse enterprises now largely depend on whether their business models can create real value for companies and customers. Analysis of the stock prices of three world-leading technology companies Although Meta has the most influential voice and business reserves in the market, its stock price fell about 20% in the first quarter of 2022, missing analysts' expectations. Facing an intense onslaught from rivals including TikTok, conventional Meta (facebook.com) user growth stagnated, with daily active users falling by a million users in one three-month period. Meanwhile, Meta's other apps, WhatsApp and Instagram, saw significant drops in user growth. Meta's Metaverse- related businesses continue to burn money and have tended for some time to hinder the company's overall development. Unlike Meta, the share price of Google, which has not put too much effort into its Metaverse business, continued to rise due to growth in its core business. Google has retained its leading position in advertising, its primary business, and Amazon and TikTok have had less short-term impact on its position. The explosion in internet traffic driven by COVID-19 has also provided a substantial boost to Google's performance, which has continued to push up its stock price. The share price of Microsoft, which announced its Metaverse business at the same time as Meta did, also rose, with some fluctuations, due to a massive breakthrough in its cloud business and solid performance in traditional software. Analysis of the stock prices of two global Metaverse companies By February 2022, Roblox's stock price was down 47% from its all- time high set in November 2021, including a drop of 27% from the start of the year. Roblox's Q3 2021 revenue was up 195% year-on- year, and analysts expected large capital flows into its stock. However, once passion for the stock cooled, investors began to pay more attention to Roblox's profits, which missed expectations. Oculus's stock price has also dropped sharply in 2022 after a steep rise in the second half of 2021. The virtual reality hardware company had previously maintained growth, aided by 2021's stock market excitement around the Metaverse. However, after this heat subsided, the many issues with Oculus head- mounted display devices, including their weight, physical and emotional discomfort, high prices, and limited consumption potential, began to attract attention again: Figure2: Share prices of Roblox and Oculus (Feb. 2021-Feb. 2022) Source: Yahoo Finance, Deloitte analysis 1,500.00 1,900.00 2,300.00 2,700.00 3,100.00 200.00 240.00 280.00 320.00 360.00 400.00 Meta, Microsoft (USD) Google (USD) 2021/2/12 2021/3/12 2021/4/12 2021/5/12 2021/6/12 2021/7/12 2021/8/12 2021/9/12 2021/10/12 2021/11/12 2021/12/12 2022/1/12 Meta Microsoft Google

Deloitte The Metaverse Overview Page 5 Page 7

Deloitte The Metaverse Overview Page 5 Page 7