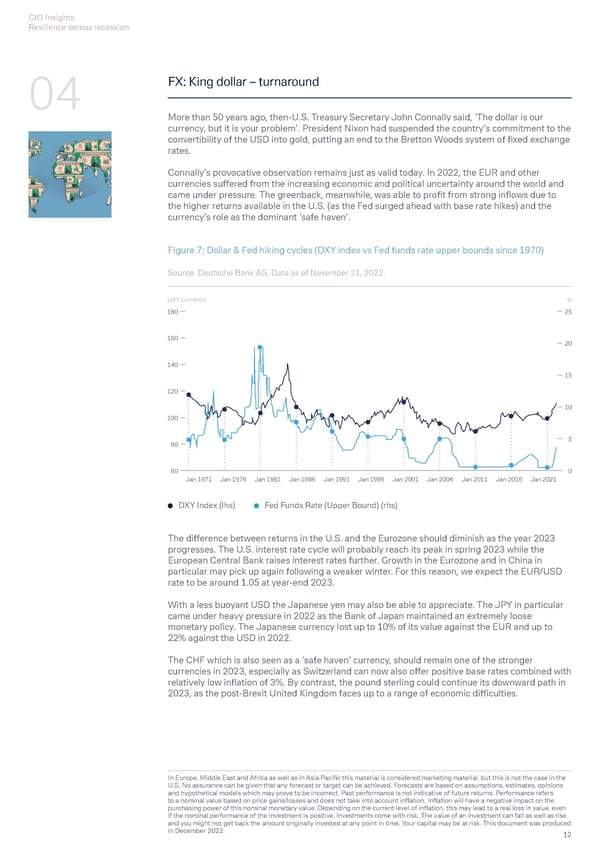

CIO Insights Resilience versus recession 04 FX: King dollar – turnaround More than 50 years ago, then-U.S. Treasury Secretary John Connally said, ‘The dollar is our currency, but it is your problem’. President Nixon had suspended the country’s commitment to the convertibility of the USD into gold, putting an end to the Bretton Woods system of fixed exchange rates. Connally’s provocative observation remains just as valid today. In 2022, the EUR and other currencies suffered from the increasing economic and political uncertainty around the world and came under pressure. The greenback, meanwhile, was able to profit from strong inflows due to the higher returns available in the U.S. (as the Fed surged ahead with base rate hikes) and the currency’s role as the dominant ‘safe haven’. Figure 7: Dollar & Fed hiking cycles (DXY index vs Fed funds rate upper bounds since 1970) Source: Deutsche Bank AG. Data as of November 21, 2022. DXY Currency % 180 25 160 20 140 15 120 10 100 80 5 60 0 Jan 1971 Jan 1976 Jan 1981 Jan 1986 Jan 1991 Jan 1996 Jan 2001 Jan 2006 Jan 2011 Jan 2016 Jan 2021 DXY Index (Ihs) Fed Funds Rate (Upper Bound) (rhs) The difference between returns in the U.S. and the Eurozone should diminish as the year 2023 progresses. The U.S. interest rate cycle will probably reach its peak in spring 2023 while the European Central Bank raises interest rates further. Growth in the Eurozone and in China in particular may pick up again following a weaker winter. For this reason, we expect the EUR/USD rate to be around 1.05 at year-end 2023. With a less buoyant USD the Japanese yen may also be able to appreciate. The JPY in particular came under heavy pressure in 2022 as the Bank of Japan maintained an extremely loose monetary policy. The Japanese currency lost up to 10% of its value against the EUR and up to 22% against the USD in 2022. The CHF which is also seen as a ‘safe haven’ currency, should remain one of the stronger currencies in 2023, especially as Switzerland can now also offer positive base rates combined with relatively low inflation of 3%. By contrast, the pound sterling could continue its downward path in 2023, as the post-Brexit United Kingdom faces up to a range of economic difficulties. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 12

Deutsche Bank Economic and Investment Outlook Page 13 Page 15

Deutsche Bank Economic and Investment Outlook Page 13 Page 15