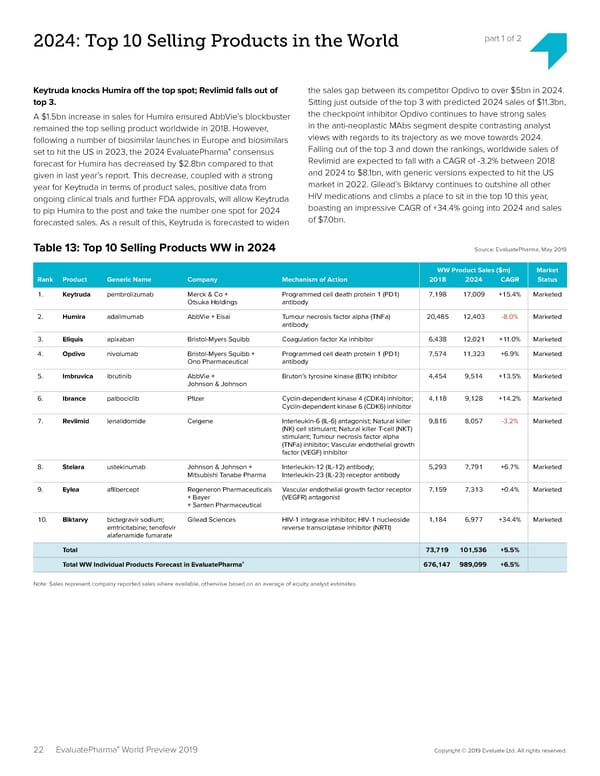

2024: Top 10 Selling Products in the World part 1 of 2 Keytruda knocks Humira o昀昀 the top spot; Revlimid falls out of the sales gap between its competitor Opdivo to over $5bn in 2024. top 3. Sitting just outside of the top 3 with predicted 2024 sales of $11.3bn, A $1.5bn increase in sales for Humira ensured AbbVie’s blockbuster the checkpoint inhibitor Opdivo continues to have strong sales remained the top selling product worldwide in 2018. However, in the anti-neoplastic MAbs segment despite contrasting analyst following a number of biosimilar launches in Europe and biosimilars views with regards to its trajectory as we move towards 2024. ® Falling out of the top 3 and down the rankings, worldwide sales of set to hit the US in 2023, the 2024 EvaluatePharma consensus forecast for Humira has decreased by $2.8bn compared to that Revlimid are expected to fall with a CAGR of -3.2% between 2018 given in last year’s report. This decrease, coupled with a strong and 2024 to $8.1bn, with generic versions expected to hit the US year for Keytruda in terms of product sales, positive data from market in 2022. Gilead’s Biktarvy continues to outshine all other ongoing clinical trials and further FDA approvals, will allow Keytruda HIV medications and climbs a place to sit in the top 10 this year, to pip Humira to the post and take the number one spot for 2024 boasting an impressive CAGR of +34.4% going into 2024 and sales forecasted sales. As a result of this, Keytruda is forecasted to widen of $7.0bn. Table 13: Top 10 Selling Products WW in 2024 Source: EvaluatePharma, May 2019 WW Product Sales ($m) Market Rank Product Generic Name Company Mechanism of Action 2018 2024 CAGR Status 1. Keytruda pembrolizumab Merck & Co + Programmed cell death protein 1 (PD1) 7,198 17,009 +15.4% Marketed Otsuka Holdings antibody 2. Humira adalimumab AbbVie + Eisai Tumour necrosis factor alpha (TNFa) 20,485 12,403 -8.0% Marketed antibody 3. Eliquis apixaban Bristol-Myers Squibb Coagulation factor Xa inhibitor 6,438 12,021 +11.0% Marketed 4. Opdivo nivolumab Bristol-Myers Squibb + Programmed cell death protein 1 (PD1) 7,574 11,323 +6.9% Marketed Ono Pharmaceutical antibody 5. Imbruvica ibrutinib AbbVie + Bruton’s tyrosine kinase (BTK) inhibitor 4,454 9,514 +13.5% Marketed Johnson & Johnson 6. Ibrance palbociclib P昀椀zer Cyclin-dependent kinase 4 (CDK4) inhibitor; 4,118 9,128 +14.2% Marketed Cyclin-dependent kinase 6 (CDK6) inhibitor 7. Revlimid lenalidomide Celgene Interleukin-6 (IL-6) antagonist; Natural killer 9,816 8,057 -3.2% Marketed (NK) cell stimulant; Natural killer T-cell (NKT) stimulant; Tumour necrosis factor alpha (TNFa) inhibitor; Vascular endothelial growth factor (VEGF) inhibitor 8. Stelara ustekinumab Johnson & Johnson + Interleukin-12 (IL-12) antibody; 5,293 7,791 +6.7% Marketed Mitsubishi Tanabe Pharma Interleukin-23 (IL-23) receptor antibody 9. Eylea a昀氀ibercept Regeneron Pharmaceuticals Vascular endothelial growth factor receptor 7,159 7,313 +0.4% Marketed + Bayer (VEGFR) antagonist + Santen Pharmaceutical 10. Biktarvy bictegravir sodium; Gilead Sciences HIV-1 integrase inhibitor; HIV-1 nucleoside 1,184 6,977 +34.4% Marketed emtricitabine; tenofovir reverse transcriptase inhibitor (NRTI) alafenamide fumarate Total 73,719 101,536 +5.5% Total WW Individual Products Forecast in EvaluatePharma® 676,147 989,099 +6.5% Note: Sales represent company reported sales where available, otherwise based on an average of equity analyst estimates. ® 22 EvaluatePharma World Preview 2019 Copyright © 2019 Evaluate Ltd. All rights reserved.

EvaluatePharma 2024 Page 21 Page 23

EvaluatePharma 2024 Page 21 Page 23