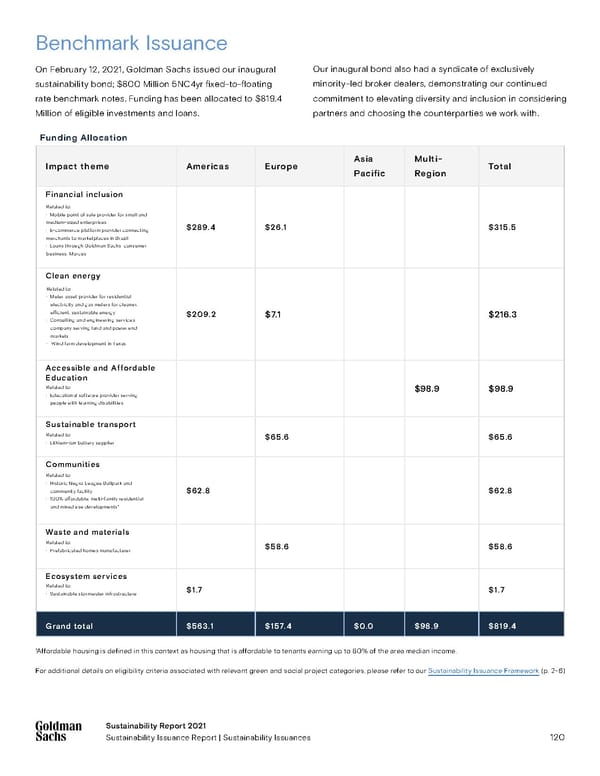

120 Benchmark Issuance On February 12, 2021, Goldman Sachs issued our inaugural sustainability bond; $800 Million 5NC4yr fixed-to-floating rate benchmark notes. Funding has been allocated to $819.4 Million of eligible investments and loans. Our inaugural bond also had a syndicate of exclusively minority-led broker dealers, demonstrating our continued commitment to elevating diversity and inclusion in considering partners and choosing the counterparties we work with. Funding Allocation Impact theme Americas Europe Asia Pacific Multi- Region Total Financial inclusion $289.4 $26.1 $315.5 Clean energy $209.2 $7.1 $216.3 Accessible and Affordable Education $98.9 $98.9 Sustainable transport $65.6 $65.6 Communities $62.8 $62.8 Waste and materials $58.6 $58.6 Ecosystem services $1.7 $1.7 Grand total $563.1 $157. 4 $0.0 $98.9 $819.4 Related to: · Mobile point of sale provider for small and medium-sized enterprises · E-commerce platform provider connecting merchants to marketplaces in Brazil · Loans through Goldman Sachs' consumer business, Marcus Related to: · Educational software provider serving people with learning disabilities Related to: · Lithium-ion battery supplier Related to: · Prefabricated homes manufacturer Related to: · Sustainable stormwater infrastructure Related to: · Historic Negro League Ballpark and community facility · 100% affordable, multi-family residential and mixed use developments¹ Related to: · Meter asset provider for residential electricity and gas meters for cleaner, efficient, sustainable energy · Consulting and engineering services company serving land and power end markets · Wind farm development in Texas Sustainability Report 2021 Sustainability Issuance Report | Sustainability Issuances ¹Affordable housing is defined in this context as housing that is affordable to tenants earning up to 80% of the area median income. For additional details on eligibility criteria associated with relevant green and social project categories, please refer to our Sustainability Issuance Framework (p. 2-6)

Goldman Sachs Group Sustainability Report Page 119 Page 121

Goldman Sachs Group Sustainability Report Page 119 Page 121