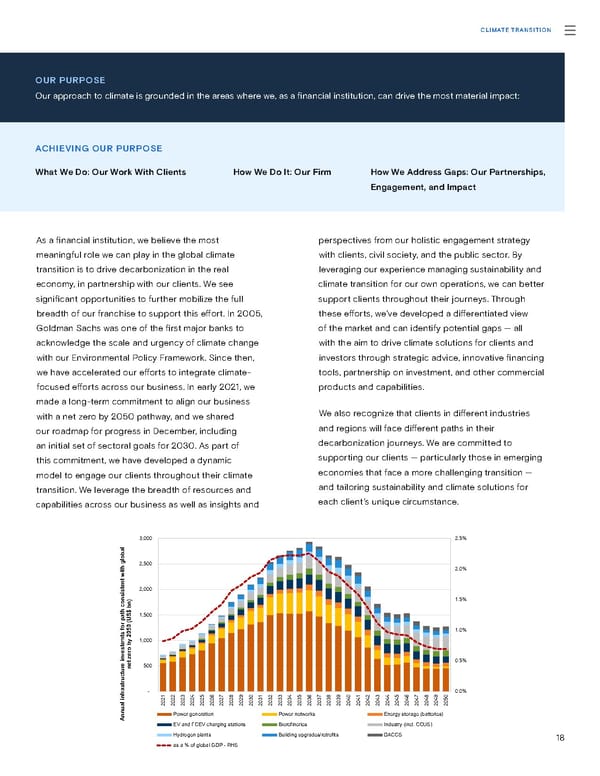

18 CLIMATE TRANSITION As a financial institution, we believe the most meaningful role we can play in the global climate transition is to drive decarbonization in the real economy, in partnership with our clients. We see significant opportunities to further mobilize the full breadth of our franchise to support this effort. In 2005, Goldman Sachs was one of the first major banks to acknowledge the scale and urgency of climate change with our Environmental Policy Framework. Since then, we have accelerated our efforts to integrate climate- focused efforts across our business. In early 2021, we made a long-term commitment to align our business with a net zero by 2050 pathway, and we shared our roadmap for progress in December, including an initial set of sectoral goals for 2030. As part of this commitment, we have developed a dynamic model to engage our clients throughout their climate transition. We leverage the breadth of resources and capabilities across our business as well as insights and perspectives from our holistic engagement strategy with clients, civil society, and the public sector. By leveraging our experience managing sustainability and climate transition for our own operations, we can better support clients throughout their journeys. Through these efforts, we’ve developed a differentiated view of the market and can identify potential gaps — all with the aim to drive climate solutions for clients and investors through strategic advice, innovative financing tools, partnership on investment, and other commercial products and capabilities. We also recognize that clients in different industries and regions will face different paths in their decarbonization journeys. We are committed to supporting our clients — particularly those in emerging economies that face a more challenging transition — and tailoring sustainability and climate solutions for each client’s unique circumstance. 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% - 500 1,000 1,500 2,000 2,500 3,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044 2045 2046 2047 2048 2049 2050 Annual infrastructure investemts for path consistent with global net zero by 2050 (US$ bn) Power generation Power networks Energy storage (batteries) EV and FCEV charging stations Biorefineries Industry (incl. CCUS) Hydrogen plants Building upgrades/retrofits DACCS as a % of global GDP - RHS ACHIEVING OUR PURPOSE What We Do: Our Work With Clients How We Do It: Our Firm How We Address Gaps: Our Partnerships, Engagement, and Impact Our approach to climate is grounded in the areas where we, as a financial institution, can drive the most material impact: OUR PURPOSE

Goldman Sachs Group Sustainability Report Page 17 Page 19

Goldman Sachs Group Sustainability Report Page 17 Page 19