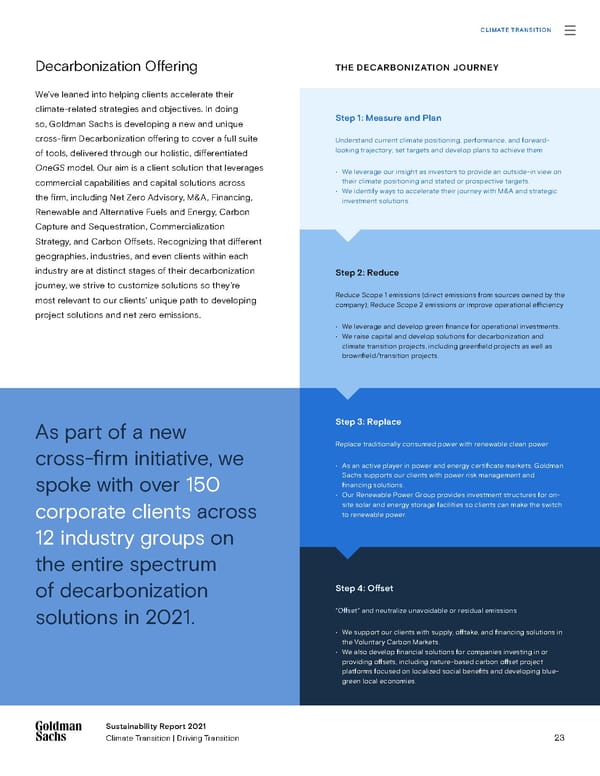

23 Sustainability Report 2021 Climate Transition | Driving Transition Decarbonization Offering We’ve leaned into helping clients accelerate their climate-related strategies and objectives. In doing so, Goldman Sachs is developing a new and unique cross-firm Decarbonization offering to cover a full suite of tools, delivered through our holistic, differentiated OneGS model. Our aim is a client solution that leverages commercial capabilities and capital solutions across the firm, including Net Zero Advisory, M&A, Financing, Renewable and Alternative Fuels and Energy, Carbon Capture and Sequestration, Commercialization Strategy, and Carbon Offsets. Recognizing that different geographies, industries, and even clients within each industry are at distinct stages of their decarbonization journey, we strive to customize solutions so they’re most relevant to our clients’ unique path to developing project solutions and net zero emissions. As part of a new cross-firm initiative, we spoke with over 150 corporate clients across 12 industry groups on the entire spectrum of decarbonization solutions in 2021. THE DECARBONIZATION JOURNEY Step 1: Measure and Plan Understand current climate positioning, performance, and forward- looking trajectory; set targets and develop plans to achieve them • We leverage our insight as investors to provide an outside-in view on their climate positioning and stated or prospective targets. • We identify ways to accelerate their journey with M&A and strategic investment solutions. Step 3: Replace Replace traditionally consumed power with renewable clean power • As an active player in power and energy certificate markets, Goldman Sachs supports our clients with power risk management and financing solutions. • Our Renewable Power Group provides investment structures for on- site solar and energy storage facilities so clients can make the switch to renewable power. Step 4: Offset “Offset” and neutralize unavoidable or residual emissions • We support our clients with supply, offtake, and financing solutions in the Voluntary Carbon Markets. • We also develop financial solutions for companies investing in or providing offsets, including nature-based carbon offset project platforms focused on localized social benefits and developing blue- green local economies. Step 2: Reduce Reduce Scope 1 emissions (direct emissions from sources owned by the company); Reduce Scope 2 emissions or improve operational efficiency • We leverage and develop green finance for operational investments. • We raise capital and develop solutions for decarbonization and climate transition projects, including greenfield projects as well as brownfield/transition projects. CLIMATE TRANSITION

Goldman Sachs Group Sustainability Report Page 22 Page 24

Goldman Sachs Group Sustainability Report Page 22 Page 24