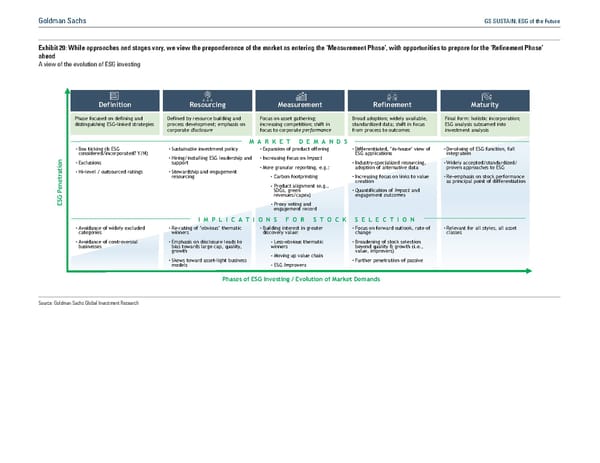

Goldman Sachs GS SUSTAIN: ESG of the Future Exhibit 20: While approaches and stages vary, we view the preponderance of the market as entering the ‘Measurement Phase, with opportunities to prepare for the ‘Refinement Phase ahead A view of the evolution of ESG investing Definition Resourcing Measurement Refinement Maturity Phase focused on defining and Defined by resource building and Focus on asset gathering; Broad adoption; widely available, Final form: holistic incorporation; distinguishing ESG-linked strategies process development; emphasis on increasing competition; shift in standardized data; shift in focus ESG analysis subsumed into corporate disclosure focus to corporate performance from process to outcomes investment analysis MARKET DEMANDS • Box ticking (Is ESG • Sustainable investment policy • Expansion of product offering • Differentiated, ‘in-house’ view of • De-siloing of ESG function, full considered/incorporated? Y/N) • Hiring/installing ESG leadership an ESG applications integration n • Exclusions support d • Increasing focus on impact • Industry-specialized resourcing, • Widely accepted/standardized/ o • More granular reporting, e.g.: adoption of alternative data proven approaches to ESG ati • Hi-level / outsourced ratings • Stewardship and engagement - Carbon footprinting tr resourcing • Increasing focus on links to value • Re-emphasis on stock performance ne creation as principal point of differentiation e -Product alignment (e.g., SDGs, green • Quantification of impact and revenues/capex) engagement outcomes ESG P -Proxy voting and engagement record IMPLICATIONS FOR STOCK SELECTION • Avoidance of widely excluded • Re-rating of ‘obvious’ thematic • Building interest in greater • Focus on forward outlook, rate of • Relevant for all styles, all asset categories winners discovery value: change classes • Avoidance of controversial • Emphasis on disclosure leads to - Less-obvious thematic • Broadening of stock selection businesses bias towards large cap, quality, winners beyond quality & growth (i.e., growth -Moving up value chain value, improvers) • Skews toward asset-light business -ESG improvers • Further penetration of passive models Phases of ESG Investing / Evolution of Market Demands Source: Goldman Sachs Global Investment Research

GS SUSTAIN: ESG of the Future Page 30 Page 32

GS SUSTAIN: ESG of the Future Page 30 Page 32