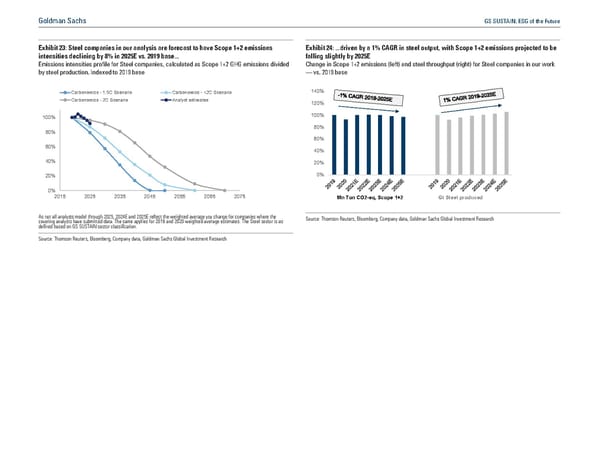

Goldman Sachs GS SUSTAIN: ESG of the Future Exhibit 23: Steel companies in our analysis are forecast to have Scope 1+2 emissions Exhibit 24: ...driven by a 1% CAGR in steel output, with Scope 1+2 emissions projected to be intensities declining by 8% in 2025E vs. 2019 base... falling slightly by 2025E Emissions intensities profile for Steel companies, calculated as Scope 1+2 GHG emissions divided Change in Scope 1+2 emissions (left) and steel throughput (right) for Steel companies in our work by steel production. Indexed to 2019 base — vs. 2019 base Carbonomics - 1.5C Scenario Carbonomics - <2C Scenario 140% Carbonomics - 2C Scenario Analyst estimates 120% 100% 100% 80% 80% 60% 60% 40% 40% 20% 20% 0% 0% 2015 2025 2035 2045 2055 2065 2075 Mn Ton CO2-eq, Scope 1+2 Gt Steel produced As not all analysts model through 2025, 2024E and 2025E reflect the weighted average yoy change for companies where the Source: Thomson Reuters, Bloomberg, Company data, Goldman Sachs Global Investment Research covering analysts have submitted data. The same applies for 2019 and 2020 weighted average estimates. The Steel sector is as de“ned based on GS SUSTAIN sector classi“cation. Source: Thomson Reuters, Bloomberg, Company data, Goldman Sachs Global Investment Research

GS SUSTAIN: ESG of the Future Page 35 Page 37

GS SUSTAIN: ESG of the Future Page 35 Page 37