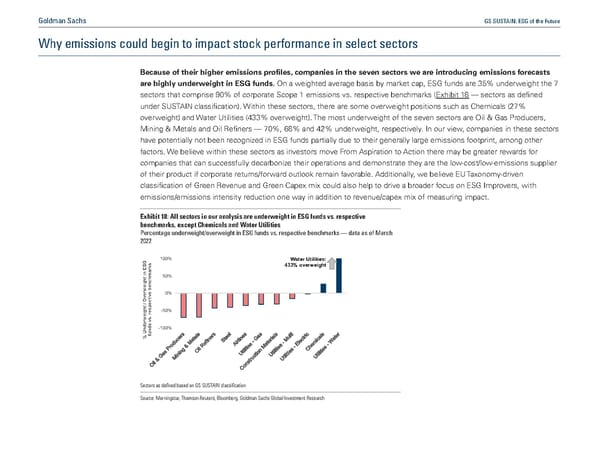

Goldman Sachs GS SUSTAIN: ESG of the Future Why emissions could begin to impact stock performance in select sectors Because of their higher emissions profiles, companies in the seven sectors we are introducing emissions forecasts are highly underweight in ESG funds. On a weighted average basis by market cap, ESG funds are 35% underweight the 7 sectors that comprise 90% of corporate Scope 1 emissions vs. respective benchmarks (Exhibit 18 — sectors as defined under SUSTAIN classification). Within these sectors, there are some overweight positions such as Chemicals (27% overweight) and Water Utilities (433% overweight). The most underweight of the seven sectors are Oil & Gas Producers, Mining & Metals and Oil Refiners — 70%, 68% and 42% underweight, respectively. In our view, companies in these sectors have potentially not been recognized in ESG funds partially due to their generally large emissions footprint, among other factors. We believe within these sectors as investors move From Aspiration to Action there may be greater rewards for companies that can successfully decarbonize their operations and demonstrate they are the low-cost/low-emissions supplier of their product if corporate returns/forward outlook remain favorable. Additionally, we believe EU Taxonomy-driven classification of Green Revenue and Green Capex mix could also help to drive a broader focus on ESG Improvers, with emissions/emissions intensity reduction one way in addition to revenue/capex mix of measuring impact. Exhibit 18: All sectors in our analysis are underweight in ESG funds vs. respective benchmarks, except Chemicals and Water Utilities Percentage underweight/overweight in ESG funds vs. respective benchmarks — data as of March 2022 100% Water Utilities: in ESG 433% overweight ight 50% ebenchmarks erwe 0% Ov / ight -50% e. respectiv s v Underw-100% funds % Sectors as de“ned based on GS SUSTAIN classi“cation Source: Morningstar, Thomson Reuters, Bloomberg, Goldman Sachs Global Investment Research

GS SUSTAIN: ESG of the Future Page 26 Page 28

GS SUSTAIN: ESG of the Future Page 26 Page 28