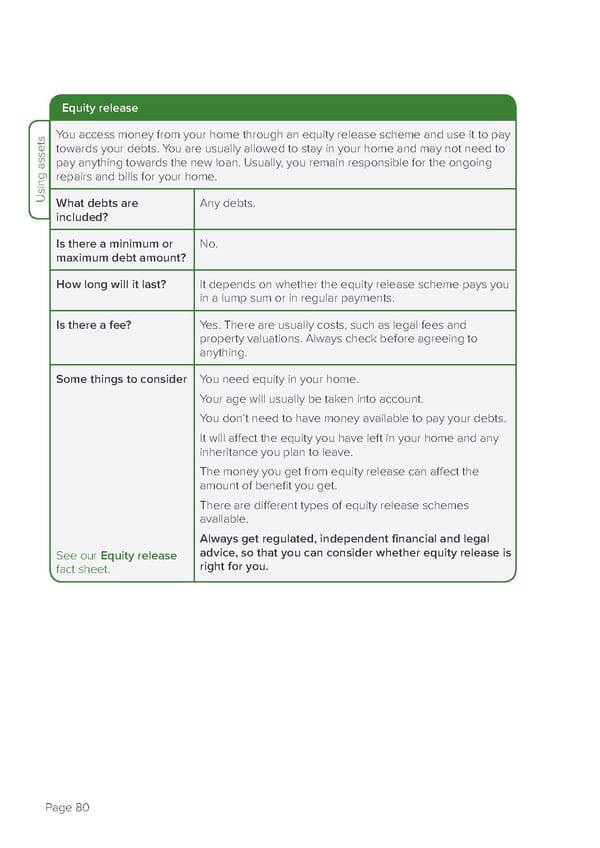

Equity release You access money from your home through an equity release scheme and use it to pay towards your debts. You are usually allowed to stay in your home and may not need to pay anything towards the new loan. Usually, you remain responsible for the ongoing repairs and bills for your home. Using assetsWhat debts are Any debts. included? Is there a minimum or No. maximum debt amount? How long will it last? It depends on whether the equity release scheme pays you in a lump sum or in regular payments. Is there a fee? Yes. There are usually costs, such as legal fees and property valuations. Always check before agreeing to anything. Some things to consider You need equity in your home. Your age will usually be taken into account. You don’t need to have money available to pay your debts. It will affect the equity you have left in your home and any inheritance you plan to leave. The money you get from equity release can affect the amount of benefit you get. There are different types of equity release schemes available. Always get regulated, independent financial and legal See our Equity release advice, so that you can consider whether equity release is fact sheet. right for you. Page 80

how-to-deal-with-debt Page 81 Page 83

how-to-deal-with-debt Page 81 Page 83