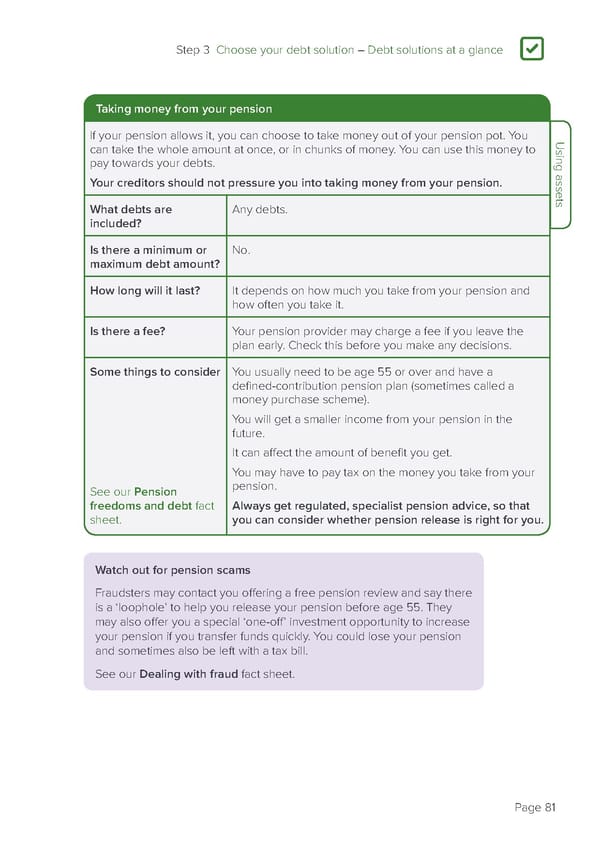

Step 3 Choose your debt solution – Debt solutions at a glance 3 Taking money from your pension If your pension allows it, you can choose to take money out of your pension pot. You Using assets can take the whole amount at once, or in chunks of money. You can use this money to pay towards your debts. Your creditors should not pressure you into taking money from your pension. What debts are Any debts. included? Is there a minimum or No. maximum debt amount? How long will it last? It depends on how much you take from your pension and how often you take it. Is there a fee? Your pension provider may charge a fee if you leave the plan early. Check this before you make any decisions. Some things to consider You usually need to be age 55 or over and have a defined-contribution pension plan (sometimes called a money purchase scheme). You will get a smaller income from your pension in the future. It can affect the amount of benefit you get. You may have to pay tax on the money you take from your See our Pension pension. freedoms and debt fact Always get regulated, specialist pension advice, so that sheet. you can consider whether pension release is right for you. Watch out for pension scams Fraudsters may contact you offering a free pension review and say there is a ‘loophole’ to help you release your pension before age 55. They may also offer you a special ‘one-off’ investment opportunity to increase your pension if you transfer funds quickly. You could lose your pension and sometimes also be left with a tax bill. See our Dealing with fraud fact sheet. Page 81

how-to-deal-with-debt Page 82 Page 84

how-to-deal-with-debt Page 82 Page 84