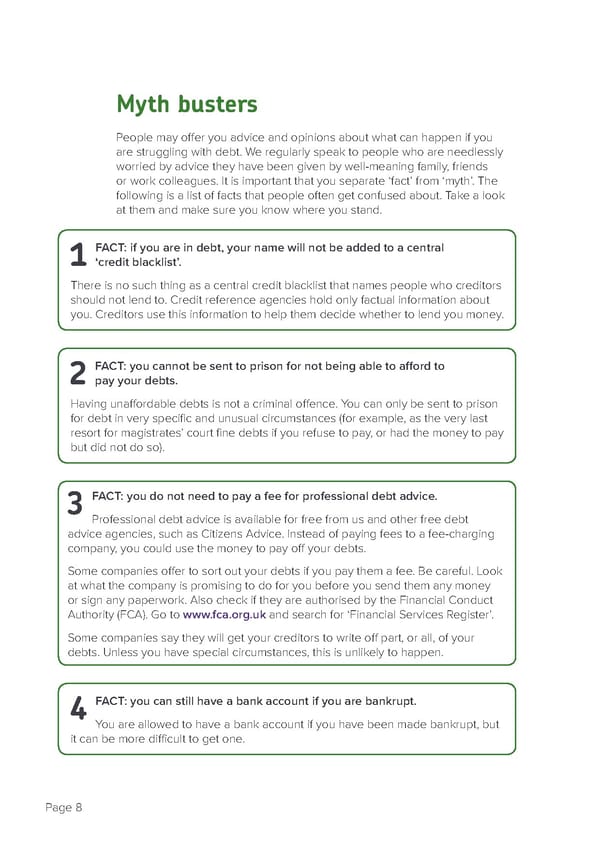

Myth busters People may offer you advice and opinions about what can happen if you are struggling with debt. We regularly speak to people who are needlessly worried by advice they have been given by well-meaning family, friends or work colleagues. It is important that you separate ‘fact’ from ‘myth’. The following is a list of facts that people often get confused about. Take a look at them and make sure you know where you stand. FACT: if you are in debt, your name will not be added to a central 1 ‘credit blacklist’. There is no such thing as a central credit blacklist that names people who creditors should not lend to. Credit reference agencies hold only factual information about you. Creditors use this information to help them decide whether to lend you money. FACT: you cannot be sent to prison for not being able to afford to 2 pay your debts. Having unaffordable debts is not a criminal offence. You can only be sent to prison for debt in very specific and unusual circumstances (for example, as the very last resort for magistrates’ court fine debts if you refuse to pay, or had the money to pay but did not do so). FACT: you do not need to pay a fee for professional debt advice. 3 Professional debt advice is available for free from us and other free debt advice agencies, such as Citizens Advice. Instead of paying fees to a fee-charging company, you could use the money to pay off your debts. Some companies offer to sort out your debts if you pay them a fee. Be careful. Look at what the company is promising to do for you before you send them any money or sign any paperwork. Also check if they are authorised by the Financial Conduct Authority (FCA). Go to www.fca.org.uk and search for ‘Financial Services Register’. Some companies say they will get your creditors to write off part, or all, of your debts. Unless you have special circumstances, this is unlikely to happen. FACT: you can still have a bank account if you are bankrupt. 4 You are allowed to have a bank account if you have been made bankrupt, but it can be more difficult to get one. Page 8

how-to-deal-with-debt Page 9 Page 11

how-to-deal-with-debt Page 9 Page 11