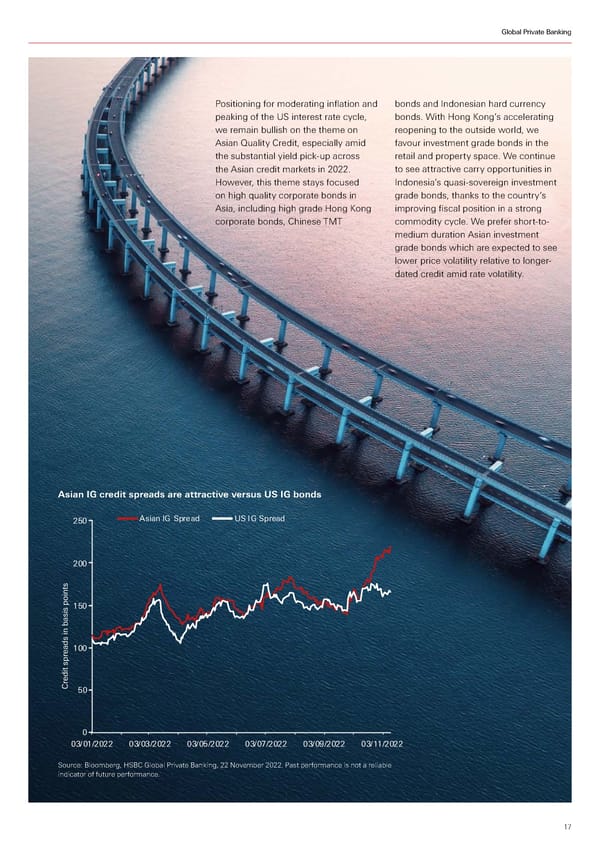

Global Private Banking Positioning for moderating inflation and bonds and Indonesian hard currency peaking of the US interest rate cycle, bonds. With Hong Kong’s accelerating we remain bullish on the theme on reopening to the outside world, we Asian Quality Credit, especially amid favour investment grade bonds in the the substantial yield pick-up across retail and property space. We continue the Asian credit markets in 2022. to see attractive carry opportunities in However, this theme stays focused Indonesia’s quasi-sovereign investment on high quality corporate bonds in grade bonds, thanks to the country’s Asia, including high grade Hong Kong improving fiscal position in a strong corporate bonds, Chinese TMT commodity cycle. We prefer short-to- medium duration Asian investment grade bonds which are expected to see lower price volatility relative to longer- dated credit amid rate volatility. Asian IG credit spreads are attractive versus US IG bonds 250 Asian IG Spread US IG Spread 200 s t n i o s p150 i s a n b s i d a 100 e r p t s i d e r C 50 0 03/01/2022 03/03/2022 03/05/2022 03/07/2022 03/09/2022 03/11/2022 Source: Bloomberg, HSBC Global Private Banking, 22 November 2022. Past performance is not a reliable indicator of future performance. 17

HSBC Investment Outlook Q1 2023 Page 16 Page 18

HSBC Investment Outlook Q1 2023 Page 16 Page 18