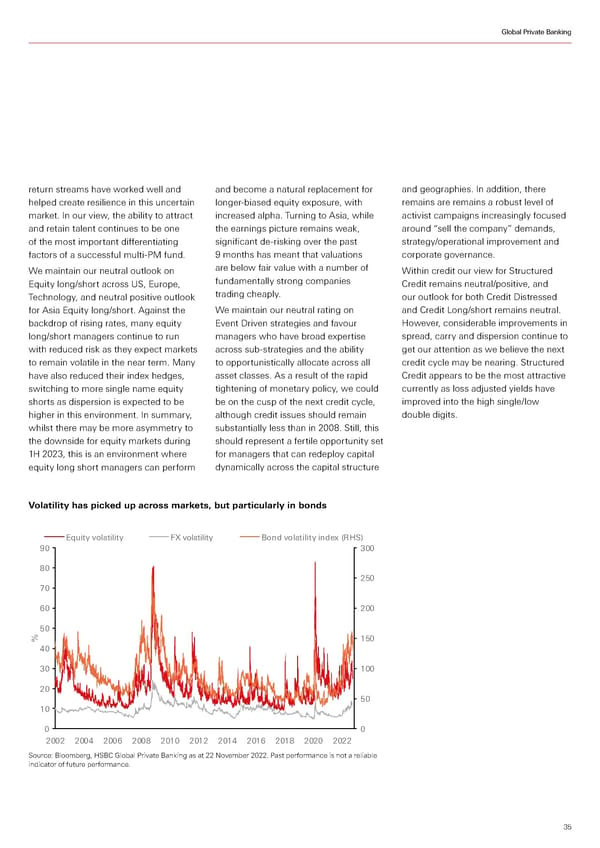

Global Private Banking return streams have worked well and and become a natural replacement for and geographies. In addition, there helped create resilience in this uncertain longer-biased equity exposure, with remains are remains a robust level of market. In our view, the ability to attract increased alpha. Turning to Asia, while activist campaigns increasingly focused and retain talent continues to be one the earnings picture remains weak, around “sell the company” demands, of the most important differentiating significant de-risking over the past strategy/operational improvement and factors of a successful multi-PM fund. 9 months has meant that valuations corporate governance. We maintain our neutral outlook on are below fair value with a number of Within credit our view for Structured Equity long/short across US, Europe, fundamentally strong companies Credit remains neutral/positive, and Technology, and neutral positive outlook trading cheaply. our outlook for both Credit Distressed for Asia Equity long/short. Against the We maintain our neutral rating on and Credit Long/short remains neutral. backdrop of rising rates, many equity Event Driven strategies and favour However, considerable improvements in long/short managers continue to run managers who have broad expertise spread, carry and dispersion continue to with reduced risk as they expect markets across sub-strategies and the ability get our attention as we believe the next to remain volatile in the near term. Many to opportunistically allocate across all credit cycle may be nearing. Structured have also reduced their index hedges, asset classes. As a result of the rapid Credit appears to be the most attractive switching to more single name equity tightening of monetary policy, we could currently as loss adjusted yields have shorts as dispersion is expected to be be on the cusp of the next credit cycle, improved into the high single/low higher in this environment. In summary, although credit issues should remain double digits. whilst there may be more asymmetry to substantially less than in 2008. Still, this the downside for equity markets during should represent a fertile opportunity set 1H 2023, this is an environment where for managers that can redeploy capital equity long short managers can perform dynamically across the capital structure Volatility has picked up across markets, but particularly in bonds Equity volatility FX volatility Bond volatility index (R 90 300 80 250 70 60 200 50 % 150 40 30 100 20 50 10 0 0 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 Source: Bloomberg, HSBC Global Private Banking as at 22 November 2022. Past performance is not a reliable indicator of future performance. 35

HSBC Investment Outlook Q1 2023 Page 34 Page 36

HSBC Investment Outlook Q1 2023 Page 34 Page 36