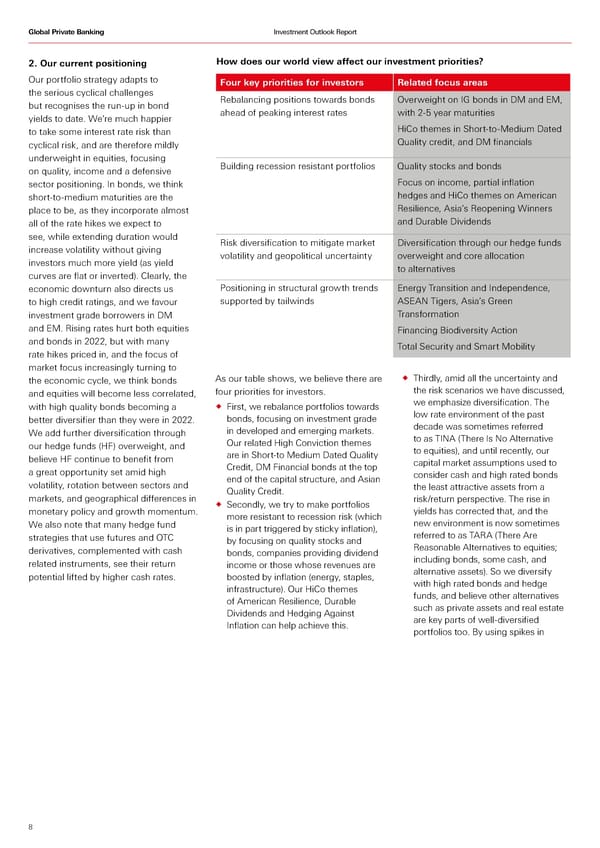

Global Private Banking Investment Outlook Report 2. Our current positioning How does our world view affect our investment priorities? Our portfolio strategy adapts to Four key priorities for investors Related focus areas the serious cyclical challenges Rebalancing positions towards bonds Overweight on IG bonds in DM and EM, but recognises the run-up in bond ahead of peaking interest rates with 2-5 year maturities yields to date. We’re much happier to take some interest rate risk than HiCo themes in Short-to-Medium Dated cyclical risk, and are therefore mildly Quality credit, and DM financials underweight in equities, focusing Building recession resistant portfolios Quality stocks and bonds on quality, income and a defensive sector positioning. In bonds, we think Focus on income, partial inflation short-to-medium maturities are the hedges and HiCo themes on American place to be, as they incorporate almost Resilience, Asia’s Reopening Winners all of the rate hikes we expect to and Durable Dividends see, while extending duration would Risk diversification to mitigate market Diversification through our hedge funds increase volatility without giving volatility and geopolitical uncertainty overweight and core allocation investors much more yield (as yield to alternatives curves are flat or inverted). Clearly, the economic downturn also directs us Positioning in structural growth trends Energy Transition and Independence, to high credit ratings, and we favour supported by tailwinds ASEAN Tigers, Asia’s Green investment grade borrowers in DM Transformation and EM. Rising rates hurt both equities Financing Biodiversity Action and bonds in 2022, but with many Total Security and Smart Mobility rate hikes priced in, and the focus of market focus increasingly turning to the economic cycle, we think bonds As our table shows, we believe there are ® Thirdly, amid all the uncertainty and and equities will become less correlated, four priorities for investors. the risk scenarios we have discussed, with high quality bonds becoming a ® First, we rebalance portfolios towards we emphasize diversification. The better diversifier than they were in 2022. bonds, focusing on investment grade low rate environment of the past We add further diversification through in developed and emerging markets. decade was sometimes referred our hedge funds (HF) overweight, and Our related High Conviction themes to as TINA (There Is No Alternative believe HF continue to benefit from are in Short-to Medium Dated Quality to equities), and until recently, our Credit, DM Financial bonds at the top capital market assumptions used to a great opportunity set amid high end of the capital structure, and Asian consider cash and high rated bonds volatility, rotation between sectors and Quality Credit. the least attractive assets from a markets, and geographical differences in ® Secondly, we try to make portfolios risk/return perspective. The rise in monetary policy and growth momentum. more resistant to recession risk (which yields has corrected that, and the We also note that many hedge fund is in part triggered by sticky inflation), new environment is now sometimes strategies that use futures and OTC by focusing on quality stocks and referred to as TARA (There Are derivatives, complemented with cash bonds, companies providing dividend Reasonable Alternatives to equities; related instruments, see their return income or those whose revenues are including bonds, some cash, and potential lifted by higher cash rates. boosted by inflation (energy, staples, alternative assets). So we diversify infrastructure). Our HiCo themes with high rated bonds and hedge of American Resilience, Durable funds, and believe other alternatives Dividends and Hedging Against such as private assets and real estate Inflation can help achieve this. are key parts of well-diversified portfolios too. By using spikes in 8

HSBC Investment Outlook Q1 2023 Page 7 Page 9

HSBC Investment Outlook Q1 2023 Page 7 Page 9