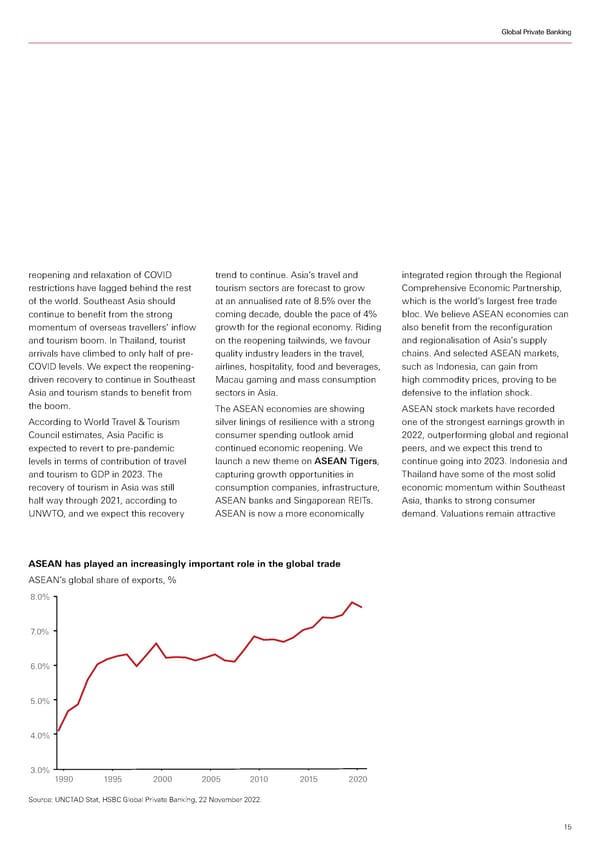

Global Private Banking reopening and relaxation of COVID trend to continue. Asia’s travel and integrated region through the Regional restrictions have lagged behind the rest tourism sectors are forecast to grow Comprehensive Economic Partnership, of the world. Southeast Asia should at an annualised rate of 8.5% over the which is the world’s largest free trade continue to benefit from the strong coming decade, double the pace of 4% bloc. We believe ASEAN economies can momentum of overseas travellers’ inflow growth for the regional economy. Riding also benefit from the reconfiguration and tourism boom. In Thailand, tourist on the reopening tailwinds, we favour and regionalisation of Asia’s supply arrivals have climbed to only half of pre- quality industry leaders in the travel, chains. And selected ASEAN markets, COVID levels. We expect the reopening- airlines, hospitality, food and beverages, such as Indonesia, can gain from driven recovery to continue in Southeast Macau gaming and mass consumption high commodity prices, proving to be Asia and tourism stands to benefit from sectors in Asia. defensive to the inflation shock. the boom. The ASEAN economies are showing ASEAN stock markets have recorded According to World Travel & Tourism silver linings of resilience with a strong one of the strongest earnings growth in Council estimates, Asia Pacific is consumer spending outlook amid 2022, outperforming global and regional expected to revert to pre-pandemic continued economic reopening. We peers, and we expect this trend to levels in terms of contribution of travel launch a new theme on ASEAN Tigers, continue going into 2023. Indonesia and and tourism to GDP in 2023. The capturing growth opportunities in Thailand have some of the most solid recovery of tourism in Asia was still consumption companies, infrastructure, economic momentum within Southeast half way through 2021, according to ASEAN banks and Singaporean REITs. Asia, thanks to strong consumer UNWTO, and we expect this recovery ASEAN is now a more economically demand. Valuations remain attractive ASEAN has played an increasingly important role in the global trade ASEAN’s global share of exports, % 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 1990 1995 2000 2005 2010 2015 2020 Source: UNCTAD Stat, HSBC Global Private Banking, 22 November 2022. 15

HSBC Investment Outlook Q1 2023 Page 14 Page 16

HSBC Investment Outlook Q1 2023 Page 14 Page 16