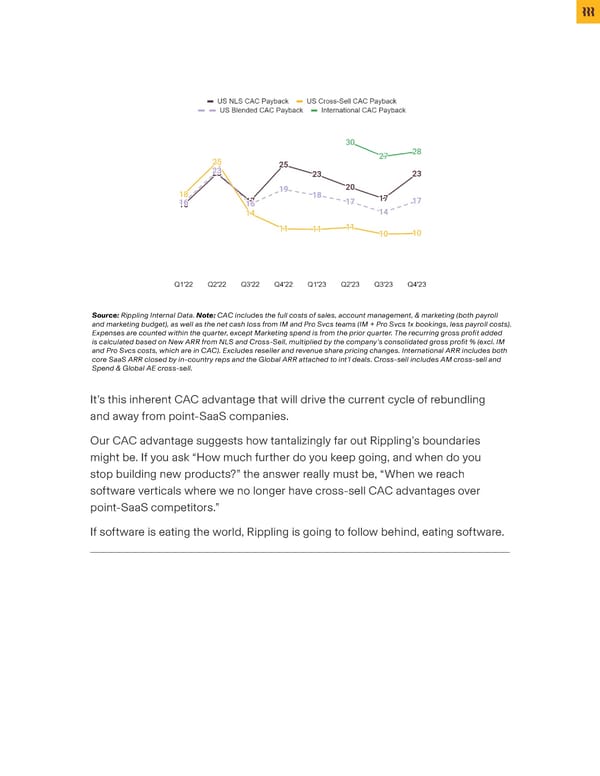

Source: Rippling Internal Data. Note: CAC includes the full costs of sales, account management, & marketing (both payroll and marketing budget), as well as the net cash loss from IM and Pro Svcs teams (IM + Pro Svcs 1x bookings, less payroll costs). Expenses are counted within the quarter, except Marketing spend is from the prior quarter. The recurring gross pro昀椀t added is calculated based on New ARR from NLS and Cross-Sell, multiplied by the company’s consolidated gross pro昀椀t % (excl. IM and Pro Svcs costs, which are in CAC). Excludes reseller and revenue share pricing changes. International ARR includes both core SaaS ARR closed by in-country reps and the Global ARR attached to int’l deals. Cross-sell includes AM cross-sell and Spend & Global AE cross-sell. It’s this inherent CAC advantage that will drive the current cycle of rebundling and away from point-SaaS companies. Our CAC advantage suggests how tantalizingly far out Rippling’s boundaries might be. If you ask “How much further do you keep going, and when do you stop building new products?” the answer really must be, “When we reach software verticals where we no longer have cross-sell CAC advantages over point-SaaS competitors.” If software is eating the world, Rippling is going to follow behind, eating software.

Investor Memo 2024 Page 14

Investor Memo 2024 Page 14