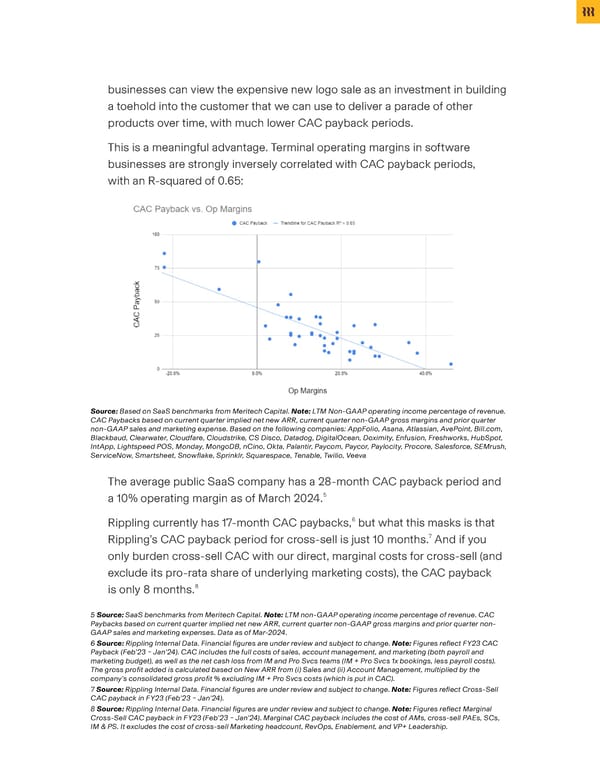

businesses can view the expensive new logo sale as an investment in building a toehold into the customer that we can use to deliver a parade of other products over time, with much lower CAC payback periods. This is a meaningful advantage. Terminal operating margins in software businesses are strongly inversely correlated with CAC payback periods, with an R-squared of 0.65: Source: Based on SaaS benchmarks from Meritech Capital. Note: LTM Non-GAAP operating income percentage of revenue. CAC Paybacks based on current quarter implied net new ARR, current quarter non-GAAP gross margins and prior quarter non-GAAP sales and marketing expense. Based on the following companies: AppFolio, Asana, Atlassian, AvePoint, Bill.com, Blackbaud, Clearwater, Cloudfare, Cloudstrike, CS Disco, Datadog, DigitalOcean, Doximity, Enfusion, Freshworks, HubSpot, IntApp, Lightspeed POS, Monday, MongoDB, nCino, Okta, Palantir, Paycom, Paycor, Paylocity, Procore, Salesforce, SEMrush, ServiceNow, Smartsheet, Snow昀氀ake, Sprinklr, Squarespace, Tenable, Twilio, Veeva The average public SaaS company has a 28-month CAC payback period and a 10% operating margin as of March 2024.5 6 Rippling currently has 17-month CAC paybacks, but what this masks is that Rippling’s CAC payback period for cross-sell is just 10 months.7 And if you only burden cross-sell CAC with our direct, marginal costs for cross-sell (and exclude its pro-rata share of underlying marketing costs), the CAC payback is only 8 months.8 5 Source: SaaS benchmarks from Meritech Capital. Note: LTM non-GAAP operating income percentage of revenue. CAC Paybacks based on current quarter implied net new ARR, current quarter non-GAAP gross margins and prior quarter non- GAAP sales and marketing expenses. Data as of Mar-2024. 6 Source: Rippling Internal Data. Financial 昀椀gures are under review and subject to change. Note: Figures re昀氀ect FY23 CAC Payback (Feb’23 – Jan’24). CAC includes the full costs of sales, account management, and marketing (both payroll and marketing budget), as well as the net cash loss from IM and Pro Svcs teams (IM + Pro Svcs 1x bookings, less payroll costs). The gross pro昀椀t added is calculated based on New ARR from (i) Sales and (ii) Account Management, multiplied by the company’s consolidated gross pro昀椀t % excluding IM + Pro Svcs costs (which is put in CAC). 7 Source: Rippling Internal Data. Financial 昀椀gures are under review and subject to change. Note: Figures re昀氀ect Cross-Sell CAC payback in FY23 (Feb’23 – Jan’24). 8 Source: Rippling Internal Data. Financial 昀椀gures are under review and subject to change. Note: Figures re昀氀ect Marginal Cross-Sell CAC payback in FY23 (Feb’23 – Jan’24). Marginal CAC payback includes the cost of AMs, cross-sell PAEs, SCs, IM & PS. It excludes the cost of cross-sell Marketing headcount, RevOps, Enablement, and VP+ Leadership.

Investor Memo 2024 Page 13 Page 15

Investor Memo 2024 Page 13 Page 15