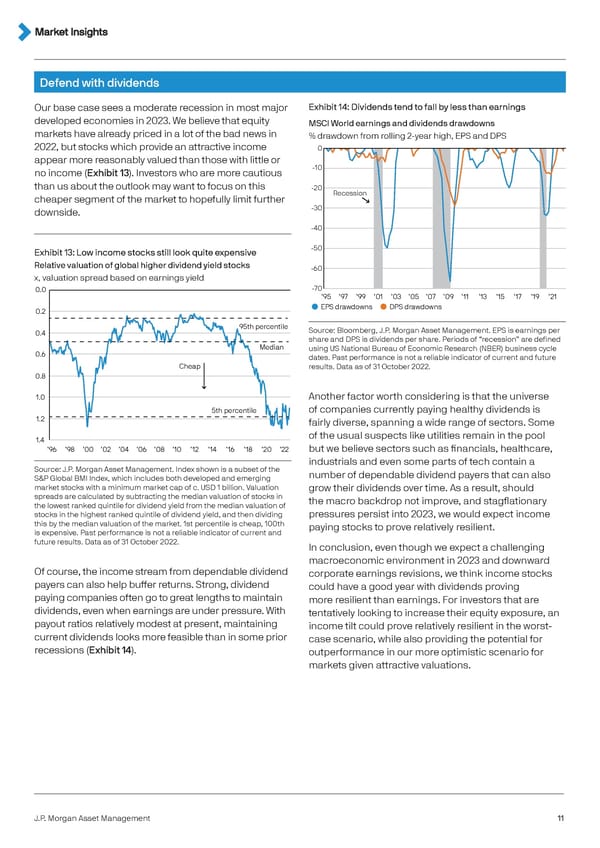

Defend with dividends Our base case sees a moderate recession in most major Exhibit 14: Dividends tend to fall by less than earnings developed economies in 2023. We believe that equity MSCI World earnings and dividends drawdowns markets have already priced in a lot of the bad news in % drawdown from rolling 2-year high, EPS and DPS 2022, but stocks which provide an attractive income 0 appear more reasonably valued than those with little or no income (Exhibit 13). Investors who are more cautious -10 than us about the outlook may want to focus on this -20 cheaper segment of the market to hopefully limit further Recession downside. -30 -40 Exhibit 13: Low income stocks still look quite expensive -50 Relative valuation of global higher dividend yield stocks -60 x, valuation spread based on earnings yield 0.0 -70 ’95 ’97 ’99 ’01 ’03 ’05 ’07 ’09 ’11 ’13 ’15 ’17 ’19 ’21 0.2 EPS drawdowns DPS drawdowns 95th percentile Source: Bloomberg, J.P. Morgan Asset Management. EPS is earnings per 0.4 share and DPS is dividends per share. Periods of “recession” are defined Median using US National Bureau of Economic Research (NBER) business cycle 0.6 dates. Past performance is not a reliable indicator of current and future Cheap results. Data as of 31 October 2022. 0.8 1.0 Another factor worth considering is that the universe 5th percentile of companies currently paying healthy dividends is 1.2 fairly diverse, spanning a wide range of sectors. Some 1.4 of the usual suspects like utilities remain in the pool ’96 ’98 ’00 ’02 ’04 ’06 ’08 ’10 ’12 ’14 ’16 ’18 ’20 ’22 but we believe sectors such as financials, healthcare, industrials and even some parts of tech contain a Source: J.P. Morgan Asset Management. Index shown is a subset of the number of dependable dividend payers that can also S&P Global BMI Index, which includes both developed and emerging market stocks with a minimum market cap of c. USD 1 billion. Valuation grow their dividends over time. As a result, should spreads are calculated by subtracting the median valuation of stocks in the macro backdrop not improve, and stagflationary the lowest ranked quintile for dividend yield from the median valuation of stocks in the highest ranked quintile of dividend yield, and then dividing pressures persist into 2023, we would expect income this by the median valuation of the market. 1st percentile is cheap, 100th paying stocks to prove relatively resilient. is expensive. Past performance is not a reliable indicator of current and future results. Data as of 31 October 2022. In conclusion, even though we expect a challenging macroeconomic environment in 2023 and downward Of course, the income stream from dependable dividend corporate earnings revisions, we think income stocks payers can also help buffer returns. Strong, dividend could have a good year with dividends proving paying companies often go to great lengths to maintain more resilient than earnings. For investors that are dividends, even when earnings are under pressure. With tentatively looking to increase their equity exposure, an payout ratios relatively modest at present, maintaining income tilt could prove relatively resilient in the worst- current dividends looks more feasible than in some prior case scenario, while also providing the potential for recessions (Exhibit 14). outperformance in our more optimistic scenario for markets given attractive valuations. J.P. Morgan Asset Management 11

J.P. Morgan Investment Outlook 2023 Page 10 Page 12

J.P. Morgan Investment Outlook 2023 Page 10 Page 12