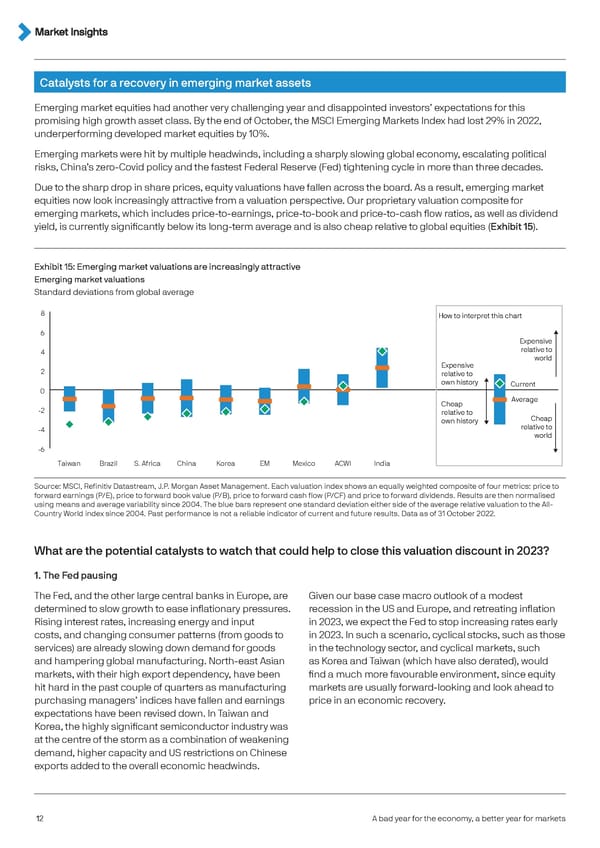

Catalysts for a recovery in emerging market assets Emerging market equities had another very challenging year and disappointed investors’ expectations for this promising high growth asset class. By the end of October, the MSCI Emerging Markets Index had lost 29% in 2022, underperforming developed market equities by 10%. Emerging markets were hit by multiple headwinds, including a sharply slowing global economy, escalating political risks, China’s zero-Covid policy and the fastest Federal Reserve (Fed) tightening cycle in more than three decades. Due to the sharp drop in share prices, equity valuations have fallen across the board. As a result, emerging market equities now look increasingly attractive from a valuation perspective. Our proprietary valuation composite for emerging markets, which includes price-to-earnings, price-to-book and price-to-cash flow ratios, as well as dividend yield, is currently significantly below its long-term average and is also cheap relative to global equities (Exhibit 15). Exhibit 15: Emerging market valuations are increasingly attractive Emerging market valuations Standard deviations from global average 8 ow o inerre hi char 6 Exenie 4 relaie o worl Exenie 2 relaie o own hior€ Crren 0 Chea Aera e -2 relaie o own hior€ Chea -4 relaie o worl -6 Taiwan Brazil S. Africa China Korea EM Mexico ACWI Inia Source: MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. Each valuation index shows an equally weighted composite of four metrics: price to forward earnings (P/E), price to forward book value (P/B), price to forward cash flow (P/CF) and price to forward dividends. Results are then normalised using means and average variability since 2004. The blue bars represent one standard deviation either side of the average relative valuation to the All- Country World index since 2004. Past performance is not a reliable indicator of current and future results. Data as of 31 October 2022. What are the potential catalysts to watch that could help to close this valuation discount in 2023? 1. The Fed pausing The Fed, and the other large central banks in Europe, are Given our base case macro outlook of a modest determined to slow growth to ease inflationary pressures. recession in the US and Europe, and retreating inflation Rising interest rates, increasing energy and input in 2023, we expect the Fed to stop increasing rates early costs, and changing consumer patterns (from goods to in 2023. In such a scenario, cyclical stocks, such as those services) are already slowing down demand for goods in the technology sector, and cyclical markets, such and hampering global manufacturing. North-east Asian as Korea and Taiwan (which have also derated), would markets, with their high export dependency, have been find a much more favourable environment, since equity hit hard in the past couple of quarters as manufacturing markets are usually forward-looking and look ahead to purchasing managers’ indices have fallen and earnings price in an economic recovery. expectations have been revised down. In Taiwan and Korea, the highly significant semiconductor industry was at the centre of the storm as a combination of weakening demand, higher capacity and US restrictions on Chinese exports added to the overall economic headwinds. 12 A bad year for the economy, a better year for markets

J.P. Morgan Investment Outlook 2023 Page 11 Page 13

J.P. Morgan Investment Outlook 2023 Page 11 Page 13