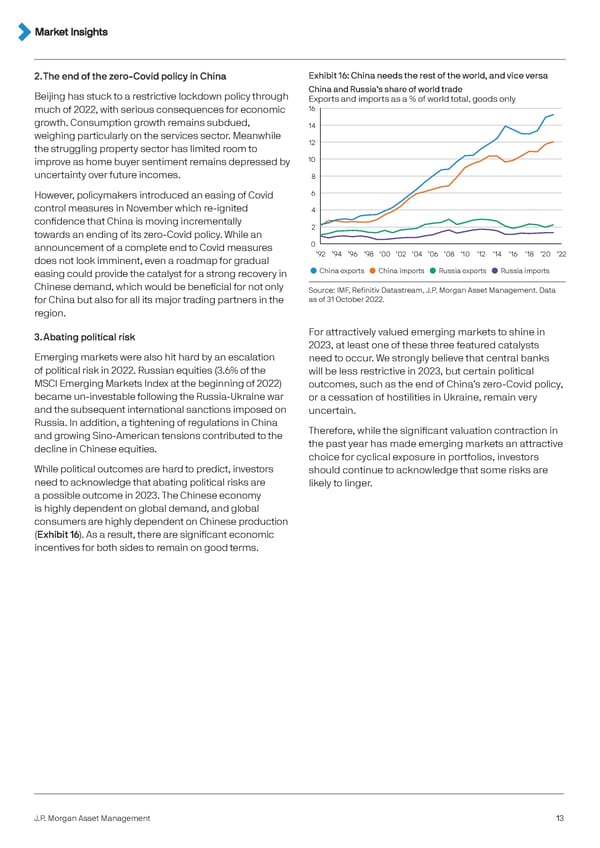

2. The end of the zero-Covid policy in China Exhibit 16: China needs the rest of the world, and vice versa Beijing has stuck to a restrictive lockdown policy through China and Russia’s share of world trade Exports and imports as a % of world total, goods only much of 2022, with serious consequences for economic 16 growth. Consumption growth remains subdued, 14 weighing particularly on the services sector. Meanwhile the struggling property sector has limited room to 12 improve as home buyer sentiment remains depressed by 10 uncertainty over future incomes. 8 However, policymakers introduced an easing of Covid 6 control measures in November which re-ignited 4 confidence that China is moving incrementally 2 towards an ending of its zero-Covid policy. While an announcement of a complete end to Covid measures 0 does not look imminent, even a roadmap for gradual ’92 ’94 ’96 ’98 ’00 ’02 ’04 ’06 ’08 ’10 ’12 ’14 ’16 ’18 ’20 ’22 easing could provide the catalyst for a strong recovery in China exports China imports Russia exports Russia imports Chinese demand, which would be beneficial for not only Source: IMF, Refinitiv Datastream, J.P. Morgan Asset Management. Data for China but also for all its major trading partners in the as of 31 October 2022. region. 3. Abating political risk For attractively valued emerging markets to shine in 2023, at least one of these three featured catalysts Emerging markets were also hit hard by an escalation need to occur. We strongly believe that central banks of political risk in 2022. Russian equities (3.6% of the will be less restrictive in 2023, but certain political MSCI Emerging Markets Index at the beginning of 2022) outcomes, such as the end of China’s zero-Covid policy, became un-investable following the Russia-Ukraine war or a cessation of hostilities in Ukraine, remain very and the subsequent international sanctions imposed on uncertain. Russia. In addition, a tightening of regulations in China Therefore, while the significant valuation contraction in and growing Sino-American tensions contributed to the the past year has made emerging markets an attractive decline in Chinese equities. choice for cyclical exposure in portfolios, investors While political outcomes are hard to predict, investors should continue to acknowledge that some risks are need to acknowledge that abating political risks are likely to linger. a possible outcome in 2023. The Chinese economy is highly dependent on global demand, and global consumers are highly dependent on Chinese production (Exhibit 16). As a result, there are significant economic incentives for both sides to remain on good terms. J.P. Morgan Asset Management 13

J.P. Morgan Investment Outlook 2023 Page 12 Page 14

J.P. Morgan Investment Outlook 2023 Page 12 Page 14