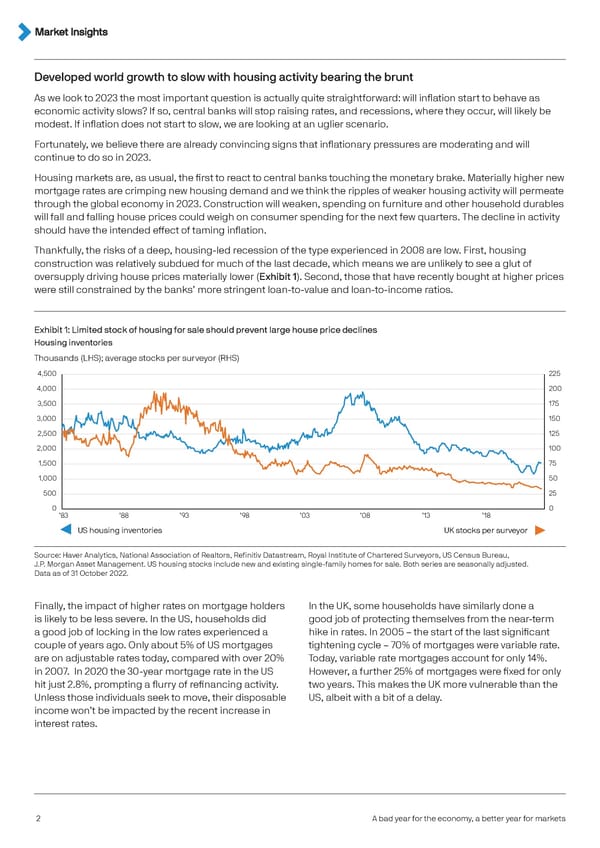

Developed world growth to slow with housing activity bearing the brunt As we look to 2023 the most important question is actually quite straightforward: will inflation start to behave as economic activity slows? If so, central banks will stop raising rates, and recessions, where they occur, will likely be modest. If inflation does not start to slow, we are looking at an uglier scenario. Fortunately, we believe there are already convincing signs that inflationary pressures are moderating and will continue to do so in 2023. Housing markets are, as usual, the first to react to central banks touching the monetary brake. Materially higher new mortgage rates are crimping new housing demand and we think the ripples of weaker housing activity will permeate through the global economy in 2023. Construction will weaken, spending on furniture and other household durables will fall and falling house prices could weigh on consumer spending for the next few quarters. The decline in activity should have the intended effect of taming inflation. Thankfully, the risks of a deep, housing-led recession of the type experienced in 2008 are low. First, housing construction was relatively subdued for much of the last decade, which means we are unlikely to see a glut of oversupply driving house prices materially lower (Exhibit 1). Second, those that have recently bought at higher prices were still constrained by the banks’ more stringent loan-to-value and loan-to-income ratios. Exhibit 1: Limited stock of housing for sale should prevent large house price declines Housing inventories Thousands (LHS); average stocks per surveyor (RHS) 4,500 225 4,000 200 3,500 175 3,000 150 2,500 125 2,000 100 1,500 75 1,000 50 500 25 0 0 ’83 ’88 ’93 ’98 ’03 ’08 ’13 ’18 US housing inventories UK stocks per surveyor Source: Haver Analytics, National Association of Realtors, Refinitiv Datastream, Royal Institute of Chartered Surveyors, US Census Bureau, J.P. Morgan Asset Management. US housing stocks include new and existing single-family homes for sale. Both series are seasonally adjusted. Data as of 31 October 2022. Finally, the impact of higher rates on mortgage holders In the UK, some households have similarly done a is likely to be less severe. In the US, households did good job of protecting themselves from the near-term a good job of locking in the low rates experienced a hike in rates. In 2005 – the start of the last significant couple of years ago. Only about 5% of US mortgages tightening cycle – 70% of mortgages were variable rate. are on adjustable rates today, compared with over 20% Today, variable rate mortgages account for only 14%. in 2007. In 2020 the 30-year mortgage rate in the US However, a further 25% of mortgages were fixed for only hit just 2.8%, prompting a flurry of refinancing activity. two years. This makes the UK more vulnerable than the Unless those individuals seek to move, their disposable US, albeit with a bit of a delay. income won’t be impacted by the recent increase in interest rates. 2 A bad year for the economy, a better year for markets

J.P. Morgan Investment Outlook 2023 Page 1 Page 3

J.P. Morgan Investment Outlook 2023 Page 1 Page 3