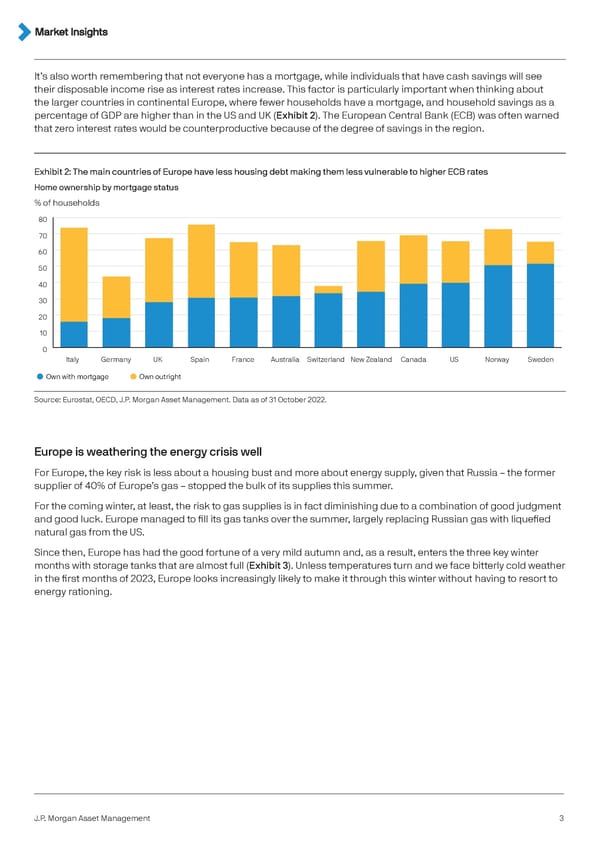

It’s also worth remembering that not everyone has a mortgage, while individuals that have cash savings will see their disposable income rise as interest rates increase. This factor is particularly important when thinking about the larger countries in continental Europe, where fewer households have a mortgage, and household savings as a percentage of GDP are higher than in the US and UK (Exhibit 2). The European Central Bank (ECB) was often warned that zero interest rates would be counterproductive because of the degree of savings in the region. Exhibit 2: The main countries of Europe have less housing debt making them less vulnerable to higher ECB rates Home ownership by mortgage status % of households 80 70 60 50 40 30 20 10 0 Italy Germany UK Spain rane utralia Switerlan ew ealan €anaa US orway Sween Own with mortgage Own outright Source: Eurostat, OECD, J.P. Morgan Asset Management. Data as of 31 October 2022. Europe is weathering the energy crisis well For Europe, the key risk is less about a housing bust and more about energy supply, given that Russia – the former supplier of 40% of Europe’s gas – stopped the bulk of its supplies this summer. For the coming winter, at least, the risk to gas supplies is in fact diminishing due to a combination of good judgment and good luck. Europe managed to fill its gas tanks over the summer, largely replacing Russian gas with liquefied natural gas from the US. Since then, Europe has had the good fortune of a very mild autumn and, as a result, enters the three key winter months with storage tanks that are almost full (Exhibit 3). Unless temperatures turn and we face bitterly cold weather in the first months of 2023, Europe looks increasingly likely to make it through this winter without having to resort to energy rationing. J.P. Morgan Asset Management 3

J.P. Morgan Investment Outlook 2023 Page 2 Page 4

J.P. Morgan Investment Outlook 2023 Page 2 Page 4