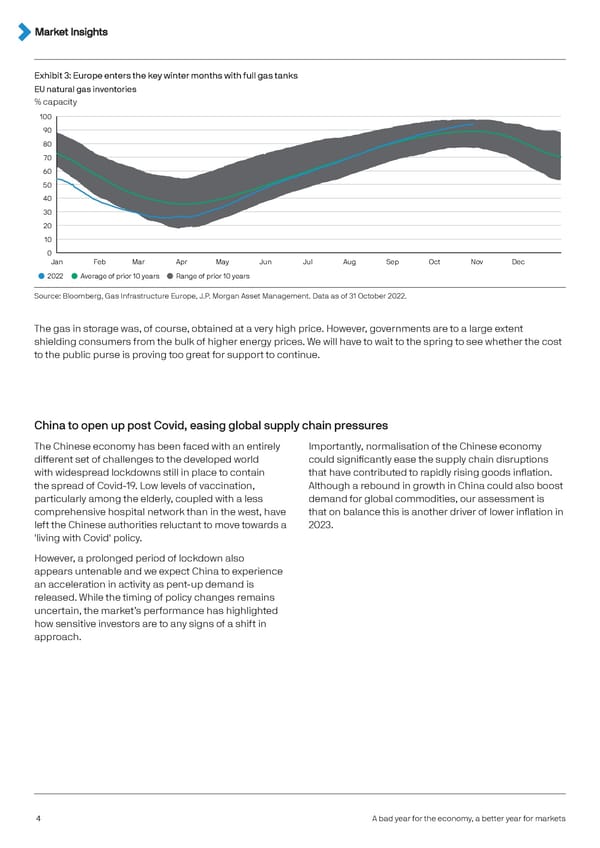

Exhibit 3: Europe enters the key winter months with full gas tanks EU natural gas inventories % capacity 100 90 80 70 60 50 40 30 20 10 0 Jan Feb Mar Apr May Jun Jul Aug ep ov e 2022 Average of prior 10 years Range of prior 10 years Source: Bloomberg, Gas Infrastructure Europe, J.P. Morgan Asset Management. Data as of 31 October 2022. The gas in storage was, of course, obtained at a very high price. However, governments are to a large extent shielding consumers from the bulk of higher energy prices. We will have to wait to the spring to see whether the cost to the public purse is proving too great for support to continue. China to open up post Covid, easing global supply chain pressures The Chinese economy has been faced with an entirely Importantly, normalisation of the Chinese economy different set of challenges to the developed world could significantly ease the supply chain disruptions with widespread lockdowns still in place to contain that have contributed to rapidly rising goods inflation. the spread of Covid-19. Low levels of vaccination, Although a rebound in growth in China could also boost particularly among the elderly, coupled with a less demand for global commodities, our assessment is comprehensive hospital network than in the west, have that on balance this is another driver of lower inflation in left the Chinese authorities reluctant to move towards a 2023. 'living with Covid' policy. However, a prolonged period of lockdown also appears untenable and we expect China to experience an acceleration in activity as pent-up demand is released. While the timing of policy changes remains uncertain, the market’s performance has highlighted how sensitive investors are to any signs of a shift in approach. 4 A bad year for the economy, a better year for markets

J.P. Morgan Investment Outlook 2023 Page 3 Page 5

J.P. Morgan Investment Outlook 2023 Page 3 Page 5