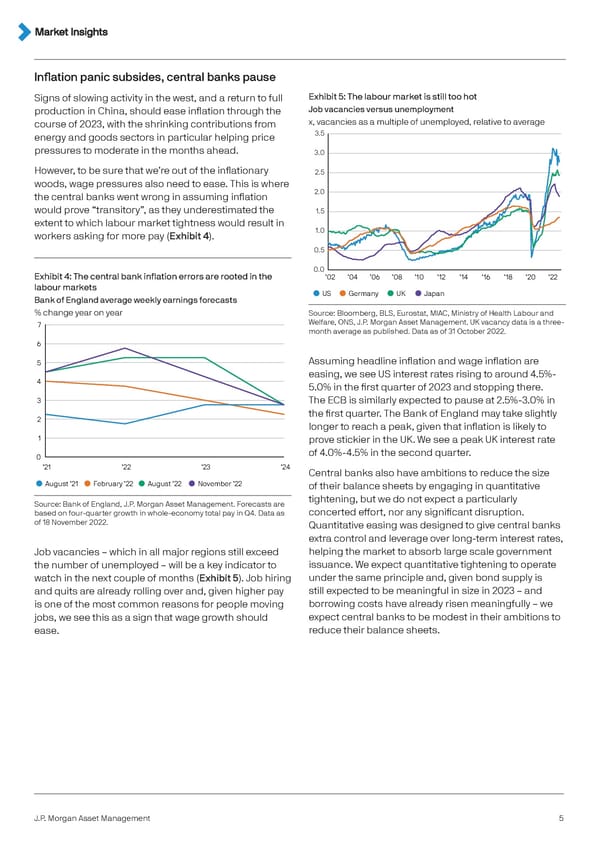

Inflation panic subsides, central banks pause Signs of slowing activity in the west, and a return to full Exhibit 5: The labour market is still too hot production in China, should ease inflation through the Job vacancies versus unemployment course of 2023, with the shrinking contributions from x, vacancies as a multiple of unemployed, relative to average energy and goods sectors in particular helping price 3.5 pressures to moderate in the months ahead. 3.0 However, to be sure that we’re out of the inflationary 2.5 woods, wage pressures also need to ease. This is where the central banks went wrong in assuming inflation 2.0 would prove “transitory”, as they underestimated the 1.5 extent to which labour market tightness would result in workers asking for more pay (Exhibit 4). 1.0 0.5 0.0 Exhibit 4: The central bank inflation errors are rooted in the ’02 ’04 ’06 ’08 ’10 ’12 ’14 ’16 ’18 ’20 ’22 labour markets US Germany UK Japan Bank of England average weekly earnings forecasts % change year on year Source: Bloomberg, BLS, Eurostat, MIAC, Ministry of Health Labour and 7 Welfare, ONS, J.P. Morgan Asset Management. UK vacancy data is a three- month average as published. Data as of 31 October 2022. 6 5 Assuming headline inflation and wage inflation are easing, we see US interest rates rising to around 4.5%- 4 5.0% in the first quarter of 2023 and stopping there. 3 The ECB is similarly expected to pause at 2.5%-3.0% in 2 the first quarter. The Bank of England may take slightly longer to reach a peak, given that inflation is likely to 1 prove stickier in the UK. We see a peak UK interest rate 0 of 4.0%-4.5% in the second quarter. ’21 ’22 ’23 ’24 Central banks also have ambitions to reduce the size August ’21 February ’22 August ’22 November ’22 of their balance sheets by engaging in quantitative Source: Bank of England, J.P. Morgan Asset Management. Forecasts are tightening, but we do not expect a particularly based on four-quarter growth in whole-economy total pay in Q4. Data as concerted effort, nor any significant disruption. of 18 November 2022. Quantitative easing was designed to give central banks extra control and leverage over long-term interest rates, Job vacancies – which in all major regions still exceed helping the market to absorb large scale government the number of unemployed – will be a key indicator to issuance. We expect quantitative tightening to operate watch in the next couple of months (Exhibit 5). Job hiring under the same principle and, given bond supply is and quits are already rolling over and, given higher pay still expected to be meaningful in size in 2023 – and is one of the most common reasons for people moving borrowing costs have already risen meaningfully – we jobs, we see this as a sign that wage growth should expect central banks to be modest in their ambitions to ease. reduce their balance sheets. J.P. Morgan Asset Management 5

J.P. Morgan Investment Outlook 2023 Page 4 Page 6

J.P. Morgan Investment Outlook 2023 Page 4 Page 6