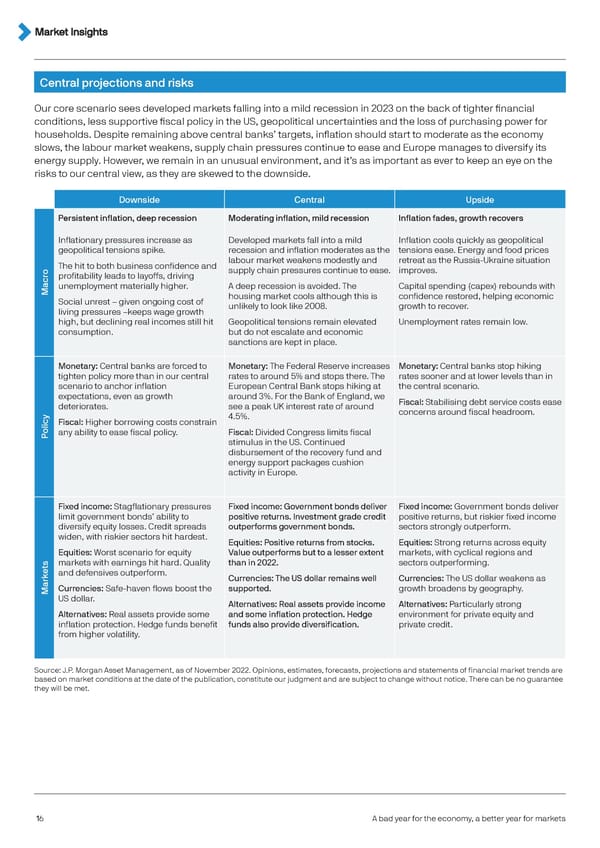

Central projections and risks Our core scenario sees developed markets falling into a mild recession in 2023 on the back of tighter financial conditions, less supportive fiscal policy in the US, geopolitical uncertainties and the loss of purchasing power for households. Despite remaining above central banks’ targets, inflation should start to moderate as the economy slows, the labour market weakens, supply chain pressures continue to ease and Europe manages to diversify its energy supply. However, we remain in an unusual environment, and it’s as important as ever to keep an eye on the risks to our central view, as they are skewed to the downside. Downside Central Upside Persistent inflation, deep recession Moderating inflation, mild recession Inflation fades, growth recovers Inflationary pressures increase as Developed markets fall into a mild Inflation cools quickly as geopolitical geopolitical tensions spike. recession and inflation moderates as the tensions ease. Energy and food prices The hit to both business confidence and labour market weakens modestly and retreat as the Russia-Ukraine situation o supply chain pressures continue to ease. improves. r profitability leads to layoffs, driving ac unemployment materially higher. A deep recession is avoided. The Capital spending (capex) rebounds with M housing market cools although this is confidence restored, helping economic Social unrest – given ongoing cost of unlikely to look like 2008. growth to recover. living pressures –keeps wage growth high, but declining real incomes still hit Geopolitical tensions remain elevated Unemployment rates remain low. consumption. but do not escalate and economic sanctions are kept in place. Monetary: Central banks are forced to Monetary: The Federal Reserve increases Monetary: Central banks stop hiking tighten policy more than in our central rates to around 5% and stops there. The rates sooner and at lower levels than in scenario to anchor inflation European Central Bank stops hiking at the central scenario. expectations, even as growth around 3%. For the Bank of England, we Fiscal: Stabilising debt service costs ease deteriorates. see a peak UK interest rate of around concerns around fiscal headroom. y 4.5%. c Fiscal: Higher borrowing costs constrain li o any ability to ease fiscal policy. Fiscal: Divided Congress limits fiscal P stimulus in the US. Continued disbursement of the recovery fund and energy support packages cushion activity in Europe. Fixed income: Stagflationary pressures Fixed income: Government bonds deliver Fixed income: Government bonds deliver limit government bonds’ ability to positive returns. Investment grade credit positive returns, but riskier fixed income diversify equity losses. Credit spreads outperforms government bonds. sectors strongly outperform. widen, with riskier sectors hit hardest. Equities: Positive returns from stocks. Equities: Strong returns across equity Equities: Worst scenario for equity Value outperforms but to a lesser extent markets, with cyclical regions and s markets with earnings hit hard. Quality than in 2022. sectors outperforming. et and defensives outperform. k Currencies: The US dollar remains well Currencies: The US dollar weakens as r a Currencies: Safe-haven flows boost the supported. growth broadens by geography. M US dollar. Alternatives: Real assets provide income Alternatives: Particularly strong Alternatives: Real assets provide some and some inflation protection. Hedge environment for private equity and inflation protection. Hedge funds benefit funds also provide diversification. private credit. from higher volatility. Source: J.P. Morgan Asset Management, as of November 2022. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met. 16 A bad year for the economy, a better year for markets

J.P. Morgan Investment Outlook 2023 Page 15 Page 17

J.P. Morgan Investment Outlook 2023 Page 15 Page 17