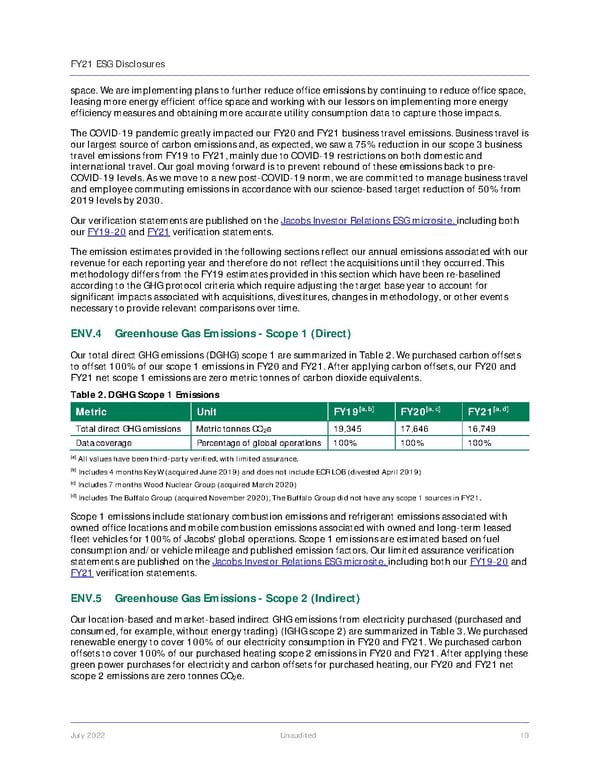

FY21 ESG Disclosures July 2022 Unaudited 10 space. We are implementing plans to further reduce office emissions by continuing to reduce office space, leasing more energy efficient office space and working with our lessors on implementing more energy efficiency measures and obtaining more accurate utility consumption data to capture those impacts. The COVID-19 pandemic greatly impacted our FY20 and FY21 business travel emissions. Business travel is our largest source of carbon emissions and, as expected, we saw a 75% reduction in our scope 3 business travel emissions from FY19 to FY21, mainly due to COVID-19 restrictions on both domestic and international travel. Our goal moving forward is to prevent rebound of these emissions back to pre- COVID-19 levels. As we move to a new post-COVID-19 norm, we are committed to manage business travel and employee commuting emissions in accordance with our science-based target reduction of 50% from 2019 levels by 2030. Our verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. The emission estimates provided in the following sections reflect our annual emissions associated with our revenue for each reporting year and therefore do not reflect the acquisitions until they occurred. This methodology differs from the FY19 estimates provided in this section which have been re-baselined according to the GHG protocol criteria which require adjusting the target base year to account for significant impacts associated with acquisitions, divestitures, changes in methodology, or other events necessary to provide relevant comparisons over time. ENV.4 Greenhouse Gas Emissions - Scope 1 (Direct) Our total direct GHG emissions (DGHG) scope 1 are summarized in Table 2. We purchased carbon offsets to offset 100% of our scope 1 emissions in FY20 and FY21. After applying carbon offsets, our FY20 and FY21 net scope 1 emissions are zero metric tonnes of carbon dioxide equivalents. Table 2. DGHG Scope 1 Emissions Metric Unit FY19 [a, b] FY20 [a, c] FY21 [a, d] Total direct GHG emissions Metric tonnes CO 2 e 19,345 17,646 16,749 Data coverage Percentage of global operations 100% 100% 100% [a] All values have been third-party verified, with limited assurance. [b] Includes 4 months KeyW (acquired June 2019) and does not include ECR LOB (divested April 2019) [c] Includes 7 months Wood Nuclear Group (acquired March 2020) [d] Includes The Buffalo Group (acquired November 2020); The Buffalo Group did not have any scope 1 sources in FY21. Scope 1 emissions include stationary combustion emissions and refrigerant emissions associated with owned office locations and mobile combustion emissions associated with owned and long-term leased fleet vehicles for 100% of Jacobs' global operations. Scope 1 emissions are estimated based on fuel consumption and/or vehicle mileage and published emission factors. Our limited assurance verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. ENV.5 Greenhouse Gas Emissions - Scope 2 (Indirect) Our location-based and market-based indirect GHG emissions from electricity purchased (purchased and consumed, for example, without energy trading) (IGHG scope 2) are summarized in Table 3. We purchased renewable energy to cover 100% of our electricity consumption in FY20 and FY21. We purchased carbon offsets to cover 100% of our purchased heating scope 2 emissions in FY20 and FY21. After applying these green power purchases for electricity and carbon offsets for purchased heating, our FY20 and FY21 net scope 2 emissions are zero tonnes CO 2 e.

Jacobs Engineering Group ESG Disclosures Page 10 Page 12

Jacobs Engineering Group ESG Disclosures Page 10 Page 12