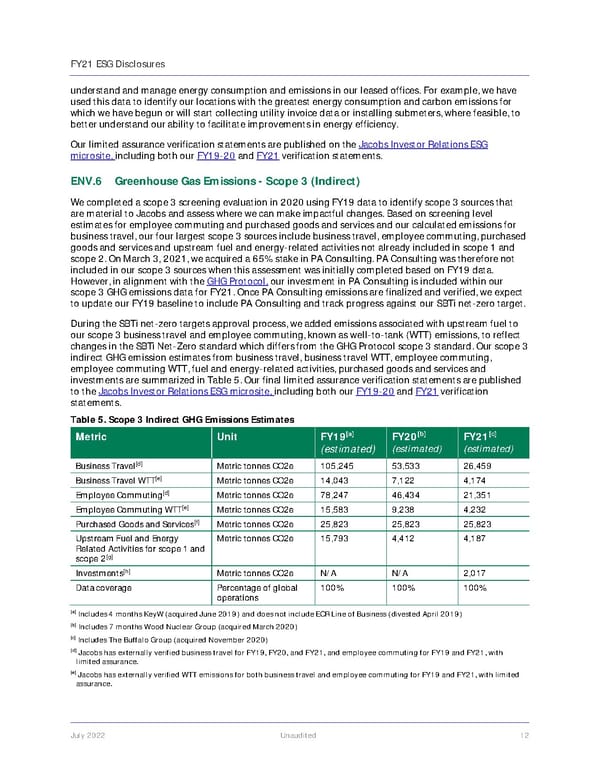

FY21 ESG Disclosures July 2022 Unaudited 12 understand and manage energy consumption and emissions in our leased offices. For example, we have used this data to identify our locations with the greatest energy consumption and carbon emissions for which we have begun or will start collecting utility invoice data or installing submeters, where feasible, to better understand our ability to facilitate improvements in energy efficiency. Our limited assurance verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. ENV.6 Greenhouse Gas Emissions - Scope 3 (Indirect) We completed a scope 3 screening evaluation in 2020 using FY19 data to identify scope 3 sources that are material to Jacobs and assess where we can make impactful changes. Based on screening level estimates for employee commuting and purchased goods and services and our calculated emissions for business travel, our four largest scope 3 sources include business travel, employee commuting, purchased goods and services and upstream fuel and energy-related activities not already included in scope 1 and scope 2. On March 3, 2021, we acquired a 65% stake in PA Consulting. PA Consulting was therefore not included in our scope 3 sources when this assessment was initially completed based on FY19 data. However, in alignment with the GHG Protocol, our investment in PA Consulting is included within our scope 3 GHG emissions data for FY21. Once PA Consulting emissions are finalized and verified, we expect to update our FY19 baseline to include PA Consulting and track progress against our SBTi net-zero target. During the SBTi net-zero targets approval process, we added emissions associated with upstream fuel to our scope 3 business travel and employee commuting, known as well-to-tank (WTT) emissions, to reflect changes in the SBTi Net-Zero standard which differs from the GHG Protocol scope 3 standard. Our scope 3 indirect GHG emission estimates from business travel, business travel WTT, employee commuting, employee commuting WTT, fuel and energy-related activities, purchased goods and services and investments are summarized in Table 5. Our final limited assurance verification statements are published to the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. Table 5. Scope 3 Indirect GHG Emissions Estimates Metric Unit FY19 [a] (estimated) FY20 [b] (estimated) FY21 [c] (estimated) Business Travel [d] Metric tonnes CO2e 105,245 53,533 26,459 Business Travel WTT [e] Metric tonnes CO2e 14,043 7,122 4,174 Employee Commuting [d] Metric tonnes CO2e 78,247 46,434 21,351 Employee Commuting WTT [e] Metric tonnes CO2e 15,583 9,238 4,232 Purchased Goods and Services [f] Metric tonnes CO2e 25,823 25,823 25,823 Upstream Fuel and Energy Related Activities for scope 1 and scope 2 [g] Metric tonnes CO2e 15,793 4,412 4,187 Investments [h] Metric tonnes CO2e N/A N/A 2,017 Data coverage Percentage of global operations 100% 100% 100% [a] Includes 4 months KeyW (acquired June 2019) and does not include ECR Line of Business (divested April 2019) [b] Includes 7 months Wood Nuclear Group (acquired March 2020) [c] Includes The Buffalo Group (acquired November 2020) [d] Jacobs has externally verified business travel for FY19, FY20, and FY21, and employee commuting for FY19 and FY21, with limited assurance. [e] Jacobs has externally verified WTT emissions for both business travel and employee commuting for FY19 and FY21, with limited assurance.

Jacobs Engineering Group ESG Disclosures Page 12 Page 14

Jacobs Engineering Group ESG Disclosures Page 12 Page 14