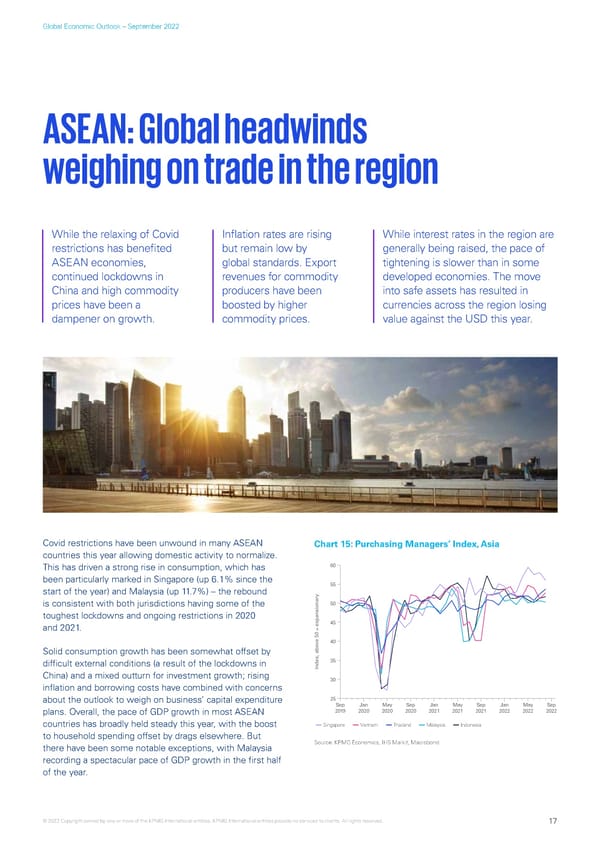

Global Economic Outlook – September 2022 ASEAN: Global headwinds weighing on trade in the region While the relaxing of Covid Inflation rates are rising While interest rates in the region are restrictions has benefited but remain low by generally being raised, the pace of ASEAN economies, global standards. Export tightening is slower than in some continued lockdowns in revenues for commodity developed economies. The move China and high commodity producers have been into safe assets has resulted in prices have been a boosted by higher currencies across the region losing dampener on growth. commodity prices. value against the USD this year. Covid restrictions have been unwound in many ASEAN Chart 15: Purchasing Managers’ Index, Asia countries this year allowing domestic activity to normalize. This has driven a strong rise in consumption, which has 60 been particularly marked in Singapore (up 6.1% since the 55 start of the year) and Malaysia (up 11.7%) – the rebound is consistent with both jurisdictions having some of the 50 toughest lockdowns and ongoing restrictions in 2020 and 2021. 45 ve 50 = expansionary40 Solid consumption growth has been somewhat offset by difficult external conditions (a result of the lockdowns in 35 Index, abo China) and a mixed outturn for investment growth; rising 30 inflation and borrowing costs have combined with concerns about the outlook to weigh on business’ capital expenditure 25 Sep Jan May Sep Jan May Sep Jan May Sep plans. Overall, the pace of GDP growth in most ASEAN 2019 2020 2020 2020 2021 2021 2021 2022 2022 2022 countries has broadly held steady this year, with the boost Singapore Vietnam Thailand Malaysia Indonesia to household spending offset by drags elsewhere. But there have been some notable exceptions, with Malaysia Source: KPMG Economics, IHS Markit, Macrobond. recording a spectacular pace of GDP growth in the first half of the year. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 17

KPMG Global Economic Outlook - H2 2022 report Page 16 Page 18

KPMG Global Economic Outlook - H2 2022 report Page 16 Page 18