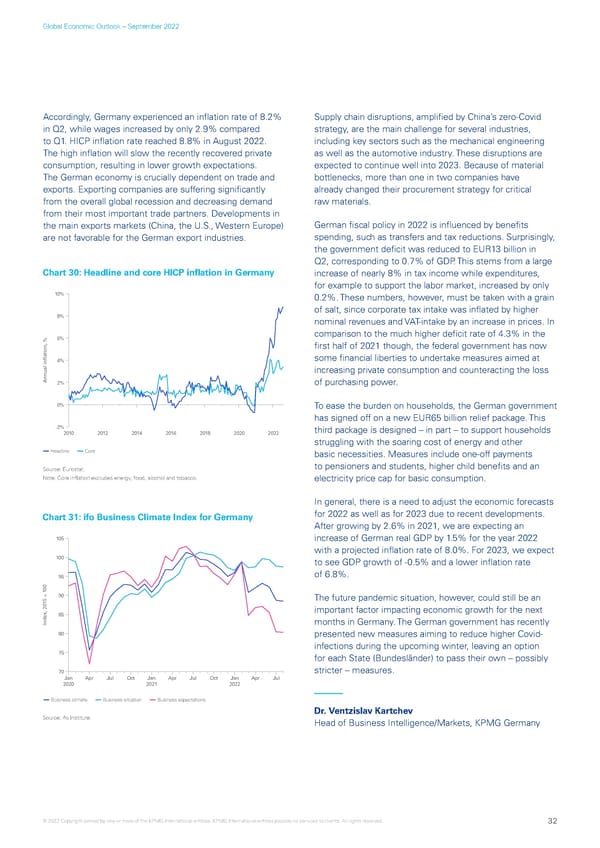

Global Economic Outlook – September 2022 Accordingly, Germany experienced an inflation rate of 8.2% Supply chain disruptions, amplified by China’s zero-Covid in Q2, while wages increased by only 2.9% compared strategy, are the main challenge for several industries, to Q1. HICP inflation rate reached 8.8% in August 2022. including key sectors such as the mechanical engineering The high inflation will slow the recently recovered private as well as the automotive industry. These disruptions are consumption, resulting in lower growth expectations. expected to continue well into 2023. Because of material The German economy is crucially dependent on trade and bottlenecks, more than one in two companies have exports. Exporting companies are suffering significantly already changed their procurement strategy for critical from the overall global recession and decreasing demand raw materials. from their most important trade partners. Developments in the main exports markets (China, the U.S., Western Europe) German fiscal policy in 2022 is influenced by benefits are not favorable for the German export industries. spending, such as transfers and tax reductions. Surprisingly, the government deficit was reduced to EUR13 billion in Q2, corresponding to 0.7% of GDP. This stems from a large Chart 30: Headline and core HICP inflation in Germany increase of nearly 8% in tax income while expenditures, for example to support the labor market, increased by only 10% 0.2%. These numbers, however, must be taken with a grain of salt, since corporate tax intake was inflated by higher 8% nominal revenues and VAT-intake by an increase in prices. In 6% comparison to the much higher deficit rate of 4.3% in the first half of 2021 though, the federal government has now 4% some financial liberties to undertake measures aimed at increasing private consumption and counteracting the loss Annual inflation, %2% of purchasing power. 0% To ease the burden on households, the German government has signed off on a new EUR65 billion relief package. This -2% third package is designed – in part – to support households 2010 2012 2014 2016 2018 2020 2022 struggling with the soaring cost of energy and other Headline Core basic necessities. Measures include one-off payments Source: Eurostat. to pensioners and students, higher child benefits and an Note: Core inflation excludes energy, food, alcohol and tobacco. electricity price cap for basic consumption. In general, there is a need to adjust the economic forecasts Chart 31: ifo Business Climate Index for Germany for 2022 as well as for 2023 due to recent developments. After growing by 2.6% in 2021, we are expecting an 105 increase of German real GDP by 1.5% for the year 2022 with a projected inflation rate of 8.0%. For 2023, we expect 100 to see GDP growth of -0.5% and a lower inflation rate 95 of 6.8%. 0 0 5 = 190 The future pandemic situation, however, could still be an 1 85 important factor impacting economic growth for the next Index, 20 months in Germany. The German government has recently 80 presented new measures aiming to reduce higher Covid- infections during the upcoming winter, leaving an option 75 for each State (Bundesländer) to pass their own – possibly 70 stricter – measures. Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul 2020 2021 2022 Business climate Business situation Business expectations Dr. Ventzislav Kartchev Source: ifo Institute. Head of Business Intelligence/Markets, KPMG Germany © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 32

KPMG Global Economic Outlook - H2 2022 report Page 31 Page 33

KPMG Global Economic Outlook - H2 2022 report Page 31 Page 33