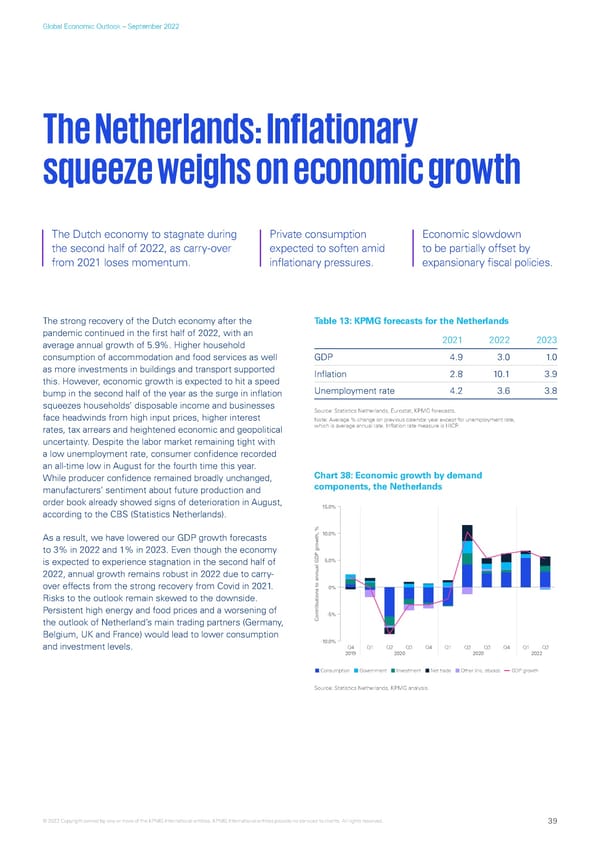

Global Economic Outlook – September 2022 The Netherlands: Inflationary squeeze weighs on economic growth The Dutch economy to stagnate during Private consumption Economic slowdown the second half of 2022, as carry-over expected to soften amid to be partially offset by from 2021 loses momentum. inflationary pressures. expansionary fiscal policies. The strong recovery of the Dutch economy after the Table 13: KPMG forecasts for the Netherlands pandemic continued in the first half of 2022, with an 2021 2022 2023 average annual growth of 5.9%. Higher household consumption of accommodation and food services as well GDP 4.9 3.0 1. 0 as more investments in buildings and transport supported Inflation 2.8 10.1 3.9 this. However, economic growth is expected to hit a speed bump in the second half of the year as the surge in inflation Unemployment rate 4.2 3.6 3.8 squeezes households’ disposable income and businesses Source: Statistics Netherlands, Eurostat, KPMG forecasts. face headwinds from high input prices, higher interest Note: Average % change on previous calendar year except for unemployment rate, rates, tax arrears and heightened economic and geopolitical which is average annual rate. Inflation rate measure is HICP. uncertainty. Despite the labor market remaining tight with a low unemployment rate, consumer confidence recorded an all-time low in August for the fourth time this year. While producer confidence remained broadly unchanged, Chart 38: Economic growth by demand manufacturers’ sentiment about future production and components, the Netherlands order book already showed signs of deterioration in August, 15.0% according to the CBS (Statistics Netherlands). As a result, we have lowered our GDP growth forecasts 10.0% to 3% in 2022 and 1% in 2023. Even though the economy is expected to experience stagnation in the second half of 5.0% 2022, annual growth remains robust in 2022 due to carry- over effects from the strong recovery from Covid in 2021. 0% Risks to the outlook remain skewed to the downside. Persistent high energy and food prices and a worsening of -5% the outlook of Netherland’s main trading partners (Germany, Contributions to annual GDP growth, % Belgium, UK and France) would lead to lower consumption -10.0% and investment levels. Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2019 2020 2020 2022 Consumption Government Investment Net trade Other (inc. stocks) GDP growth Source: Statistics Netherlands, KPMG analysis. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 39

KPMG Global Economic Outlook - H2 2022 report Page 38 Page 40

KPMG Global Economic Outlook - H2 2022 report Page 38 Page 40