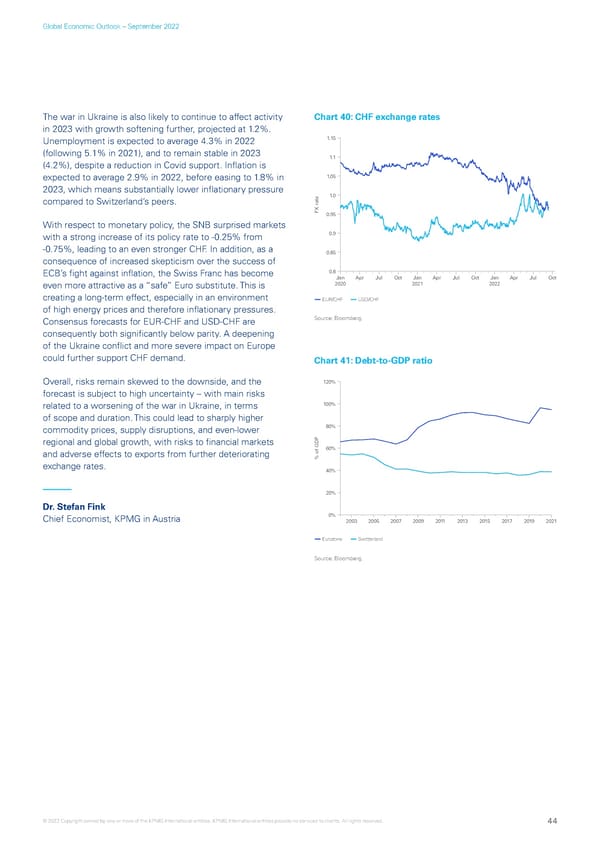

Global Economic Outlook – September 2022 The war in Ukraine is also likely to continue to affect activity Chart 40: CHF exchange rates in 2023 with growth softening further, projected at 1.2%. Unemployment is expected to average 4.3% in 2022 1.15 (following 5.1% in 2021), and to remain stable in 2023 1.1 (4.2%), despite a reduction in Covid support. Inflation is expected to average 2.9% in 2022, before easing to 1.8% in 1.05 2023, which means substantially lower inflationary pressure compared to Switzerland’s peers. 1.0 FX rate0.95 With respect to monetary policy, the SNB surprised markets with a strong increase of its policy rate to -0.25% from 0.9 -0.75%, leading to an even stronger CHF. In addition, as a 0.85 consequence of increased skepticism over the success of ECB’s fight against inflation, the Swiss Franc has become 0.8 Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct even more attractive as a “safe” Euro substitute. This is 2020 2021 2022 creating a long-term effect, especially in an environment EUR/CHF USD/CHF of high energy prices and therefore inflationary pressures. Consensus forecasts for EUR-CHF and USD-CHF are Source: Bloomberg. consequently both significantly below parity. A deepening of the Ukraine conflict and more severe impact on Europe could further support CHF demand. Chart 41: Debt-to-GDP ratio Overall, risks remain skewed to the downside, and the 120% forecast is subject to high uncertainty – with main risks related to a worsening of the war in Ukraine, in terms 100% of scope and duration. This could lead to sharply higher commodity prices, supply disruptions, and even-lower 80% regional and global growth, with risks to financial markets and adverse effects to exports from further deteriorating 60% % of GDP exchange rates. 40% 20% Dr. Stefan Fink Chief Economist, KPMG in Austria 0% 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 Eurozone Switzerland Source: Bloomberg. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 44

KPMG Global Economic Outlook - H2 2022 report Page 43 Page 45

KPMG Global Economic Outlook - H2 2022 report Page 43 Page 45