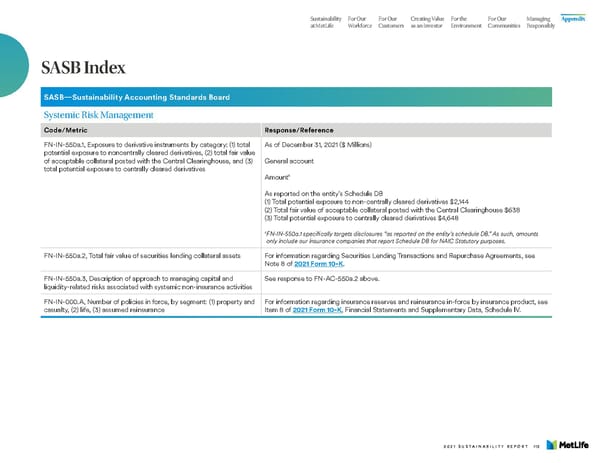

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly SASB Index SASB—Sustainability Accounting Standards Board Systemic Risk Management Code/Metric Response/Reference FN-IN-550a.1, Exposure to derivative instruments by category: (1) total As of December 31, 2021 ($ Millions) potential exposure to noncentrally cleared derivatives, (2) total fair value of acceptable collateral posted with the Central Clearinghouse, and (3) General account total potential exposure to centrally cleared derivatives 1 Amount As reported on the entity’s Schedule DB (1) Total potential exposure to non-centrally cleared derivatives $2,144 (2) Total fair value of acceptable collateral posted with the Central Clearinghouse $638 (3) Total potential exposure to centrally cleared derivatives $4,648 1 FN-IN-550a.1 specifically targets disclosures “as reported on the entity’s schedule DB.” As such, amounts only include our insurance companies that report Schedule DB for NAIC Statutory purposes. FN-IN-550a.2, Total fair value of securities lending collateral assets For information regarding Securities Lending Transactions and Repurchase Agreements, see Note 8 of 2021 Form 10-K. FN-IN-550a.3, Description of approach to managing capital and See response to FN-AC-550a.2 above. liquidity-related risks associated with systemic non-insurance activities FN-IN-000.A, Number of policies in force, by segment: (1) property and For information regarding insurance reserves and reinsurance in-force by insurance product, see casualty, (2) life, (3) assumed reinsurance Item 8 of 2021 Form 10-K, Financial Statements and Supplementary Data, Schedule lV. 2021 SUSTAINABILITY REPORT 112

MetLife Sustainability Report Page 113 Page 115

MetLife Sustainability Report Page 113 Page 115