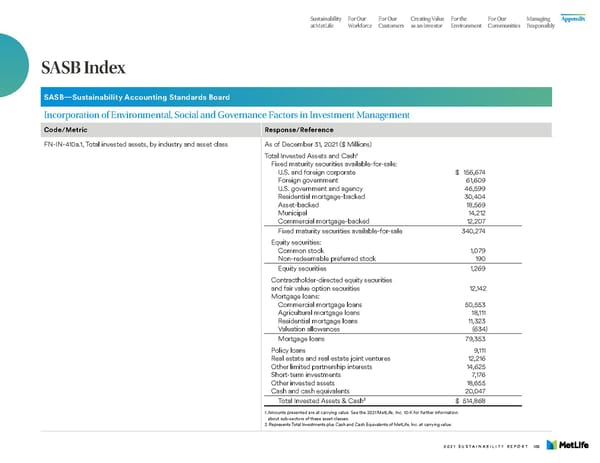

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly SASB Index SASB—Sustainability Accounting Standards Board Incorporation of Environmental, Social and Governance Factors in Investment Management Code/Metric Response/Reference FN-IN-410a.1, Total invested assets, by industry and asset class As of December 31, 2021 ($ Millions) 1 Total Invested Assets and Cash Fixed maturity securities available-for-sale: U.S. and foreign corporate $ 156,674 Foreign government 61,609 U.S. government and agency 46,599 Residential mortgage-backed 30,404 Asset-backed 18,569 Municipal 14,212 Commercial mortgage-backed 12,207 Fixed maturity securities available-for-sale 340,274 Equity securities: Common stock 1,079 Non-redeemable preferred stock 190 Equity securities 1,269 Contractholder-directed equity securities and fair value option securities 12,142 Mortgage loans: Commercial mortgage loans 50,553 Agricultural mortgage loans 18,111 Residential mortgage loans 11,323 Valuation allowances (634) Mortgage loans 79,353 Policy loans 9,111 Real estate and real estate joint ventures 12,216 Other limited partnership interests 14,625 Short-term investments 7,176 Other invested assets 18,655 Cash and cash equivalents 20,047 2 Total Invested Assets & Cash $ 514,868 1. Amounts presented are at carrying value. See the 2021 MetLife, Inc. 10-K for further information about sub-sectors of these asset classes. 2. Represents Total Investments plus Cash and Cash Equivalents of MetLife, Inc. at carrying value. 2021 SUSTAINABILITY REPORT 108

MetLife Sustainability Report Page 109 Page 111

MetLife Sustainability Report Page 109 Page 111