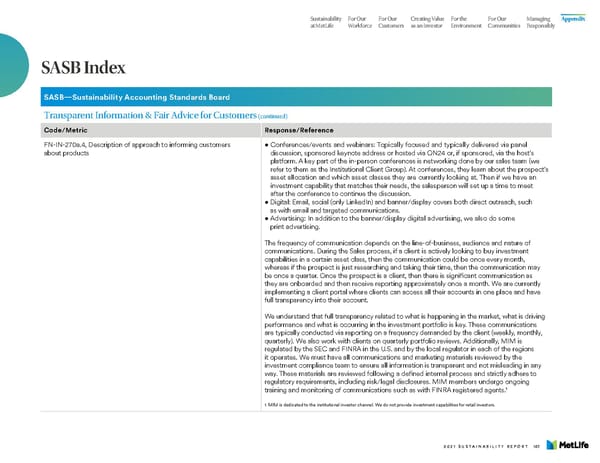

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly SASB Index SASB—Sustainability Accounting Standards Board Transparent Information & Fair Advice for Customers (continued) Code/Metric Response/Reference FN-IN-270a.4, Description of approach to informing customers • Con ferences/events and webinars: Topically focused and typically delivered via panel about products discussion, sponsored keynote address or hosted via ON24 or, if sponsored, via the host’s platform. A key part of the in-person conferences is networking done by our sales team (we refer to them as the Institutional Client Group). At conferences, they learn about the prospect’s asset allocation and which asset classes they are currently looking at. Then if we have an investment capability that matches their needs, the salesperson will set up a time to meet after the conference to continue the discussion. • D igital: Email, social (only LinkedIn) and banner/display covers both direct outreach, such as with email and targeted communications. • Advertising: In addition to the banner/display digital advertising, we also do some print advertising. The frequency of communication depends on the line-of-business, audience and nature of communications. During the Sales process, if a client is actively looking to buy investment capabilities in a certain asset class, then the communication could be once every month, whereas if the prospect is just researching and taking their time, then the communication may be once a quarter. Once the prospect is a client, then there is significant communication as they are onboarded and then receive reporting approximately once a month. We are currently implementing a client portal where clients can access all their accounts in one place and have full transparency into their account. We understand that full transparency related to what is happening in the market, what is driving performance and what is occurring in the investment portfolio is key. These communications are typically conducted via reporting on a frequency demanded by the client (weekly, monthly, quarterly). We also work with clients on quarterly portfolio reviews. Additionally, MIM is regulated by the SEC and FINRA in the U.S. and by the local regulator in each of the regions it operates. We must have all communications and marketing materials reviewed by the investment compliance team to ensure all information is transparent and not misleading in any way. These materials are reviewed following a defined internal process and strictly adhere to regulatory requirements, including risk/legal disclosures. MIM members undergo ongoing 1 training and monitoring of communications such as with FINRA registered agents. 1. MIM is dedicated to the institutional investor channel. We do not provide investment capabilities for retail investors. 2021 SUSTAINABILITY REPORT 107

MetLife Sustainability Report Page 108 Page 110

MetLife Sustainability Report Page 108 Page 110