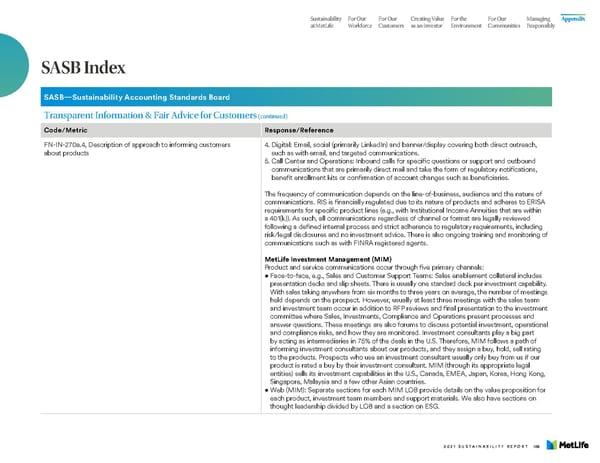

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly SASB Index SASB—Sustainability Accounting Standards Board Transparent Information & Fair Advice for Customers (continued) Code/Metric Response/Reference FN-IN-270a.4, Description of approach to informing customers 4. Digital: Email, social (primarily LinkedIn) and banner/display covering both direct outreach, about products such as with email, and targeted communications. 5. Call Center and Operations: Inbound calls for specific questions or support and outbound communications that are primarily direct mail and take the form of regulatory notifications, benefit enrollment kits or confirmation of account changes such as beneficiaries. The frequency of communication depends on the line-of-business, audience and the nature of communications. RIS is financially regulated due to its nature of products and adheres to ERISA requirements for specific product lines (e.g., with Institutional Income Annuities that are within a 401(k)). As such, all communications regardless of channel or format are legally reviewed following a defined internal process and strict adherence to regulatory requirements, including risk/legal disclosures and no investment advice. There is also ongoing training and monitoring of communications such as with FINRA registered agents. MetLife Investment Management (MIM) Product and service communications occur through five primary channels: • F ace-to-face, e.g., Sales and Customer Support Teams: Sales enablement collateral includes presentation decks and slip sheets. There is usually one standard deck per investment capability. With sales taking anywhere from six months to three years on average, the number of meetings held depends on the prospect. However, usually at least three meetings with the sales team and investment team occur in addition to RFP reviews and final presentation to the investment committee where Sales, Investments, Compliance and Operations present processes and answer questions. These meetings are also forums to discuss potential investment, operational and compliance risks, and how they are monitored. Investment consultants play a big part by acting as intermediaries in 75% of the deals in the U.S. Therefore, MIM follows a path of informing investment consultants about our products, and they assign a buy, hold, sell rating to the products. Prospects who use an investment consultant usually only buy from us if our product is rated a buy by their investment consultant. MIM (through its appropriate legal entities) sells its investment capabilities in the U.S., Canada, EMEA, Japan, Korea, Hong Kong, Singapore, Malaysia and a few other Asian countries. • W eb (MIM): Separate sections for each MIM LOB provide details on the value proposition for each product, investment team members and support materials. We also have sections on thought leadership divided by LOB and a section on ESG. 2021 SUSTAINABILITY REPORT 106

MetLife Sustainability Report Page 107 Page 109

MetLife Sustainability Report Page 107 Page 109