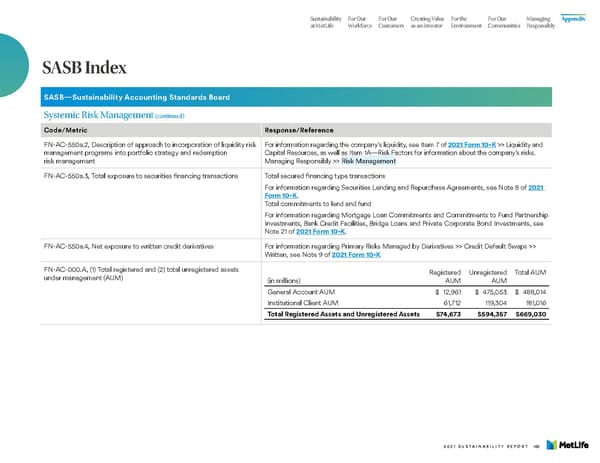

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly SASB Index SASB—Sustainability Accounting Standards Board Systemic Risk Management (continued) Code/Metric Response/Reference FN-AC-550a.2, Description of approach to incorporation of liquidity risk For information regarding the company’s liquidity, see Item 7 of 2021 Form 10-K >> Liquidity and management programs into portfolio strategy and redemption Capital Resources, as well as Item 1A—Risk Factors for information about the company’s risks. risk management Managing Responsibly >> Risk Management FN-AC-550a.3, Total exposure to securities financing transactions Total secured financing type transactions For information regarding Securities Lending and Repurchase Agreements, see Note 8 of 2021 Form 10-K. Total commitments to lend and fund For information regarding Mortgage Loan Commitments and Commitments to Fund Partnership Investments, Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments, see Note 21 of 2021 Form 10-K. FN-AC-550a.4, Net exposure to written credit derivatives For information regarding Primary Risks Managed by Derivatives >> Credit Default Swaps >> Written, see Note 9 of 2021 Form 10-K FN-AC-000.A, (1) Total registered and (2) total unregistered assets Registered Unregistered Total AUM under management (AUM) (in millions) AUM AUM General Account AUM $ 12,961 $ 475,053 $ 488,014 Institutional Client AUM 61,712 119,304 181,016 Total Registered Assets and Unregistered Assets $74,673 $594,357 $669,030 2021 SUSTAINABILITY REPORT 102

MetLife Sustainability Report Page 103 Page 105

MetLife Sustainability Report Page 103 Page 105