New Hire Benefit Guide

Your journey to enrollment starts here.

NewHire Benefit Guide 2024

YOURJOURNEYTO ENROLLMENT STARTSHERE HOWTO USE THIS GUIDE CARRIER CONTACTS When you see the icons below, click to link out websites, ADDITIONAL SUPPORT download documents, or learn more!

NEW HIRE ENROLLMENT New hires have 30 days from their date of hire to enroll in benefits in ADP. Benefits are effective the first of the month following your date of hire. MID-YEAR CHANGES Once your New Hire enrollment window closes, the only time you are allowed to make changes to your benefits elections in the middle of the year is if you experience a qualified mid-year change. Examples may include getting married or divorced, having a baby or adopting, or gaining or losing coverage. You must notify Human Resources within 30 days of the mid- year event to be eligible to change your elections. INSURANCE IS COMPLICATED. CONTACT HR WITH QUESTIONS.

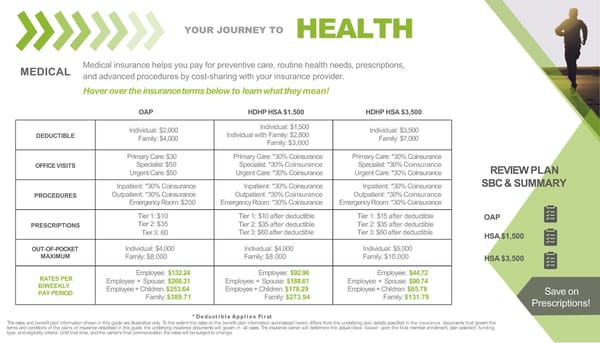

YOURJOURNEYTO HEALTH MEDICAL Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean! OAP HDHP HSA $1,500 HDHP HSA $3,500 Individual: $2,000 Individual: $1,500 Individual: $3,500 DEDUCTIBLE Family: $4,000 Individual with Family: $2,800 Family: $7,000 Family: $3,000 Primary Care: $30 Primary Care: *30% Coinsurance Primary Care: *30% Coinsurance OFFICE VISITS Specialist: $50 Specialist: *30% Coinsurance Specialist: *30% Coinsurance REVIEW PLAN Urgent Care: $50 Urgent Care: *30% Coinsurance Urgent Care: *30% Coinsurance Inpatient: *30% Coinsurance Inpatient: *30% Coinsurance Inpatient: *30% Coinsurance SBC & SUMMARY PROCEDURES Outpatient: *30% Coinsurance Outpatient: *30% Coinsurance Outpatient: *30% Coinsurance Emergency Room: $200 Emergency Room: *30% Coinsurance Emergency Room: *30% Coinsurance Tier 1: $10 Tier 1: $10 after deductible Tier 1: $15 after deductible OAP PRESCRIPTIONS Tier 2: $35 Tier 2: $35 after deductible Tier 2: $35 after deductible Tier 3: 60 Tier 3: $60 after deductible Tier 3: $60 after deductible HSA $1,500 OUT-OF-POCKET Individual: $4,000 Individual: $4,000 Individual: $5,000 MAXIMUM Family: $8,000 Family: $8,000 Family: $10,000 HSA $3,500 RATES PER Employee: $132.24 Employee: $92.96 Employee: $44.72 BIWEEKLY Employee + Spouse: $268.31 Employee + Spouse: $188.61 Employee + Spouse: $90.74 PAY PERIOD Employee + Children: $253.64 Employee + Children: $178.29 Employee + Children: $85.78 Save on Family: $389.71 Family: $273.94 Family: $131.79 Prescriptions! * D e d u ct i b l e A p p l i e s Fi r st The rates and benefit plan information shown in this guide are illustrative only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. The insurance carrier will determine the actual rates based upon the final member enrollment, plan selection, funding, type, and eligibility criteria. Until that time, and the carrier's final communication, the rates will be subject to change.

If you think your physical health alone TELEMEDICINE is related to your overall performance, EMPLOYEE ASSISTANCE think again. Total Wellbeing as a whole is comprised of 5 elements: physical, financial, communal, emotional, and purpose. To build your overall wellbeing, you have to make sure all of Your life is an adventure, and these elements are being “exercised”. You encounter more than just health Telemedicine affords you the concerns throughout your life. convenience of receiving medical care Manage life’s curveballs with a while on the go. Instead of spending confidential and complimentary your day and dollars at an Urgent program designed to provide Care facility, connect with a board- counseling, support, and resources for certified doctor over the phone or video a variety of personal issues like stress chat to receive immediate and cost- and anxiety, relationship struggles, effective care wherever life’s journey substance abuse, eldercare, may take you. financial worries, and much more. Check your plan summary for costs Get the FREE support you need today: Benefits 101 Telemedicine WELLBEING

HEALTH SAVINGS ACCOUNT YOUR Take advantage of triple tax savings through an HSA. Reduce your taxable SAVINGS income by contributing into this account, purchase qualified healthcare items JOURNEY free of tax, and earn tax- free interest on HSAinvestment dollars. TO Unused funds will roll over from year to year. You must be enrolled in the company HDHP Medical Plan to be eligible for an HSA. FLEXIBLE SPENDING ACCOUNT Savetax dollars and receive an advanced loan to assistwith qualified expenses with an FSA. Determine your per paycheckcontribution in the beginning of the year, and then spend those funds on qualified health expenses or dependent care expenses asneeded before the plan year ends. The benefit plan information shown in this guide is illustrative only. Tothe extent the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

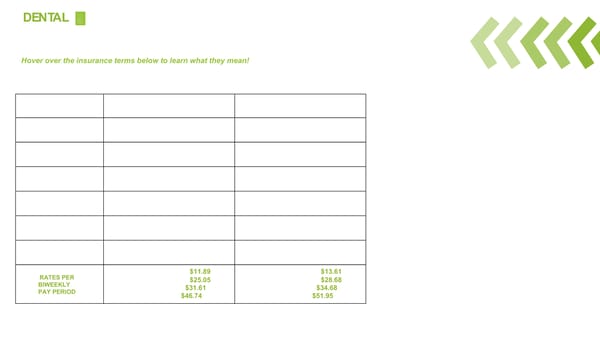

DENTAL Good dental hygiene has substantial impact on your overall health. Prevent oral both conditions and other diseases through regular preventive dental care. Hover over the insurance terms below to learn what they mean! DPPO LOW PLAN DPPO HIGH PLAN ANNUAL Individual: $50 Individual: $50 DEDUCTIBLE Family: $150 Family: $150 PREVENTIVE 100% 100% SERVICES BASIC 70% 70% SERVICES MAJOR 50% 50% SERVICES ANNUAL PLAN $1,000 $1,000 MAXIMUM ORTHO 50% 50% SERVICES Children Only Children Only ORTHO $1,000 $1,500 LIFETIME MAXIMUM RATES PER Employee: $11.89 Employee: $13.61 BIWEEKLY Employee + Spouse: $25.05 Employee + Spouse: $28.68 PAY PERIOD Employee + Children: $31.61 Employee + Children: $34.68 Family: $46.74 Family: $51.95 The rates and benefit plan information shown in this guide are illustrative only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. The insurance carrier will determine the actual rates based upon the final member enrollment, plan selection, funding, type, and eligibility criteria. Until that time, and the carrier's final communication, the rates will be subject to change.

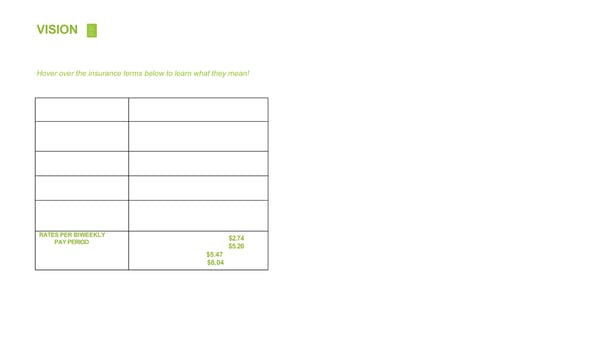

VISION Protect your sight and enjoy those sunsets even more with vision insurance. Receive both preventive and materials coverage. Hover over the insurance terms below to learn what they mean! DPPO LOW PLAN LENSES Single:$25 Bifocal:$25 Trifocal: $25 FRAMES $150 Allowance CONTACT LENSES Disposable: $150 Allowance FREQUENCY OF Lenses: 1 X 12 months SERVICES Frames: 1 X 24 months Contact Lenses: 1 X 12 months RATES PER BIWEEKLY Employee: $2.74 PAY PERIOD Employee + Spouse: $5.20 Employee + Children: $5.47 Family: $8.04 The rates and benefit plan information shown in this guide are illustrative only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. The insurance carrier will determine the actual rates based upon the final member enrollment, plan selection, funding, type, and eligibility criteria. Until that time, and the carrier's final communication, the rates will be subject to change.

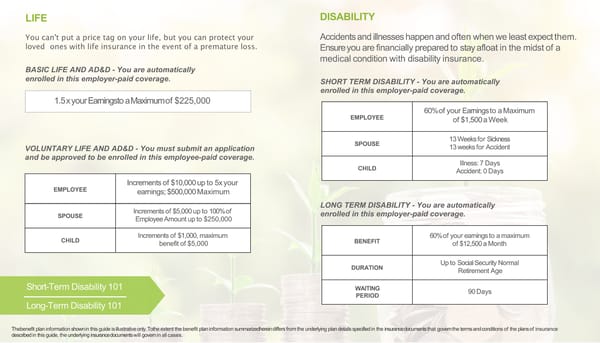

LIFE DISABILITY You can't put a price tag on your life, but you can protect your Accidents and illnesses happen and often when we least expect them. loved ones with life insurance in the event of a premature loss. Ensure you are financially prepared to stay afloat in the midst of a medical condition with disability insurance. BASIC LIFE AND AD&D - You are automatically enrolled in this employer-paid coverage. SHORT TERM DISABILITY - You are automatically enrolled in this employer-paid coverage. 1.5 x your Earningsto a Maximum of $225,000 60% of your Earnings to a Maximum EMPLOYEE of $1,500 a Week SPOUSE 13 Weeks for Sickness VOLUNTARY LIFE AND AD&D - You must submit an application 13 weeks for Accident and be approved to be enrolled in this employee-paid coverage. Illness: 7 Days CHILD Accident: 0 Days Increments of $10,000 up to 5x your EMPLOYEE earnings; $500,000 Maximum Increments of $5,000 up to 100% of LONG TERM DISABILITY - You are automatically SPOUSE Employee Amount up to $250,000 enrolled in this employer-paid coverage. CHILD Increments of $1,000, maximum BENEFIT 60% of your earnings to a maximum benefit of $5,000 of $12,500 a Month DURATION Up to Social Security Normal Retirement Age Short-Term Disability 101 WAITING 90 Days PERIOD Long-Term Disability 101 Thebenefit plan information shown in this guide is illustrative only. Tothe extent the benefit plan information summarizedherein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

RETIREMENT The key to saving for retirement is to start early and stay committed. Making the choice to invest in yourself by contributing to your employer sponsored retirement plan is a decision that may have a big impact on your ability to retire confidently. CONTRIBUTION TYPE Acme Corp offers traditional pre-tax deferrals and Roth deferrals on a percentage of earnings basisinto the Acme Corp, Inc. 401(k) Plan with American Funds. Acme Corp} matches 50% of up to 5%of eligible earnings each pay period. There is a three EMPLOYER MATCH year vesting period for company contributions. Toget the full match: if you put in 5%the company puts in 2.5% Hover over the iconsbelow to learn a few benefits of contributing! YOUR SAVINGS OURNEY J TO

VOLUNTARY BENEFITS S Even with medical insurance, you Voluntary Benefits: T could still be subject to unexpected I out-of-pocket expenses in the form • Critical Illness of copays, deductible, and & coinsurance. Voluntary Benefits • Accident provide lump sum payments to be • Tuition Reimbursement used towards your health care BENEF expenses, or however you see fit. ARY UNT NAL LUCKY YOU! L O Your employer offers a I handful of non traditional T benefits to support you VO and your family as you juggle life's demands. Hover over the icons ADDI to learn more about your options. The benefit plan information shown in this guide is illustrative only. To the extent the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

Employee Notices Please review the following required employee notices detailing your rights and options. You can also request a paper copy of any of these notices at any time. READY TO ENROLL?