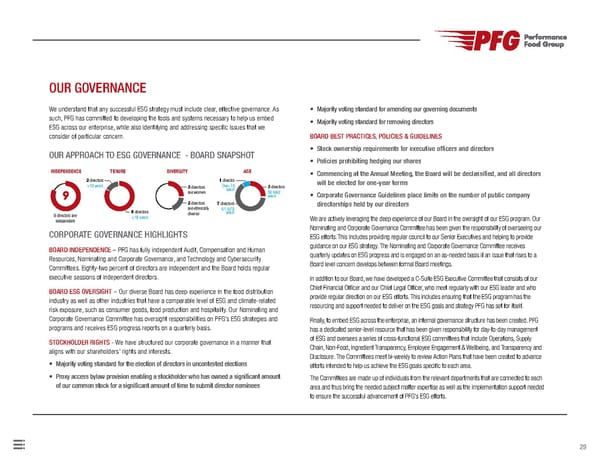

29 9 INDEPENDENCE TENURE DIVERSITY AGE 9 directors are independent 2 directors >10 years 9 directors <10 years 3 directors are women 2 directors are ethnically diverse 1 director Over 70 years 7 directors 61 to70 years 3 directors 50 to60 years OUR GOVERNANCE We understand that any successful ESG strategy must include clear, effective governance. As such, PFG has committed to developing the tools and systems necessary to help us embed ESG across our enterprise, while also identifying and addressing specific issues that we consider of particular concern. OUR APPROACH TO ESG GOVERNANCE - BOARD SNAPSHOT CORPORATE GOVERNANCE HIGHLIGHTS BOARD INDEPENDENCE – PFG has fully independent Audit, Compensation and Human Resources, Nominating and Corporate Governance, and Technology and Cybersecurity Committees. Eighty-two percent of directors are independent and the Board holds regular executive sessions of independent directors. BOARD ESG OVERSIGHT – Our diverse Board has deep experience in the food distribution industry as well as other industries that have a comparable level of ESG and climate-related risk exposure, such as consumer goods, food production and hospitality. Our Nominating and Corporate Governance Committee has oversight responsibilities on PFG’s ESG strategies and programs and receives ESG progress reports on a quarterly basis. STOCKHOLDER RIGHTS - We have structured our corporate governance in a manner that aligns with our shareholders’ rights and interests. • Majority voting standard for the election of directors in uncontested elections • Proxy access bylaw provision enabling a stockholder who has owned a significant amount of our common stock for a significant amount of time to submit director nominees • Majority voting standard for amending our governing documents • Majority voting standard for removing directors BOARD BEST PRACTICES, POLICIES & GUIDELINES • Stock ownership requirements for executive officers and directors • Policies prohibiting hedging our shares • Commencing at the Annual Meeting, the Board will be declassified, and all directors will be elected for one-year terms • Corporate Governance Guidelines place limits on the number of public company directorships held by our directors We are actively leveraging the deep experience of our Board in the oversight of our ESG program. Our Nominating and Corporate Governance Committee has been given the responsibility of overseeing our ESG efforts. This includes providing regular council to our Senior Executives and helping to provide guidance on our ESG strategy. The Nominating and Corporate Governance Committee receives quarterly updates on ESG progress and is engaged on an as-needed basis if an issue that rises to a Board level concern develops between formal Board meetings. In addition to our Board, we have developed a C-Suite ESG Executive Committee that consists of our Chief Financial Officer and our Chief Legal Officer, who meet regularly with our ESG leader and who provide regular direction on our ESG efforts. This includes ensuring that the ESG program has the resourcing and support needed to deliver on the ESG goals and strategy PFG has set for itself. Finally, to embed ESG across the enterprise, an internal governance structure has been created. PFG has a dedicated senior-level resource that has been given responsibility for day-to-day management of ESG and oversees a series of cross-functional ESG committees that include Operations, Supply Chain, Non-Food, Ingredient Transparency, Employee Engagement & Wellbeing, and Transparency and Disclosure. The Committees meet bi-weekly to review Action Plans that have been created to advance efforts intended to help us achieve the ESG goals specific to each area. The Committees are made up of individuals from the relevant departments that are connected to each area and thus bring the needed subject matter expertise as well as the implementation support needed to ensure the successful advancement of PFG’s ESG efforts.

Performance Food Group ESG Report Page 28 Page 30

Performance Food Group ESG Report Page 28 Page 30