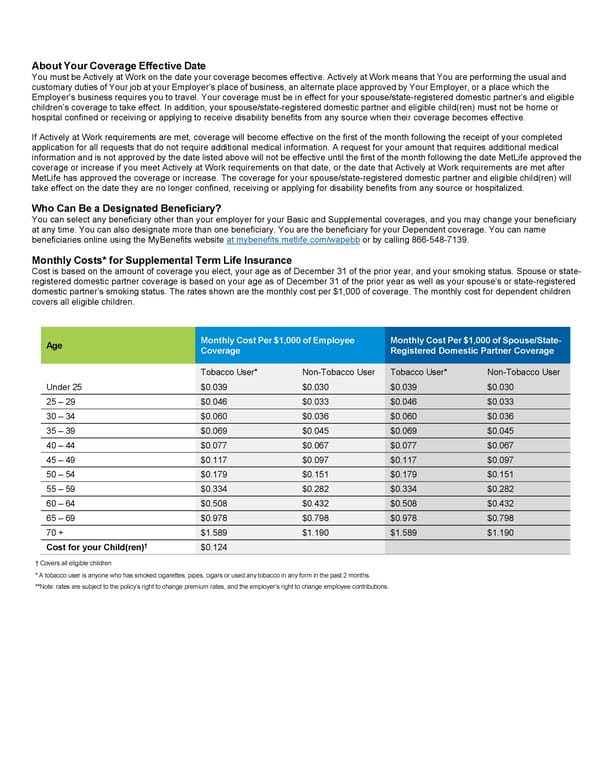

About Your Coverage Effective Date You must be Actively at Work on the date your coverage becomes effective. Actively at Work means that You are performing the usual and customary duties of Your job at your Employer’s place of business, an alternate place approved by Your Employer, or a place which the Employer’s business requires you to travel. Your coverage must be in effect for your spouse/state-registered domestic partner’s and eligible children’s coverage to take effect. In addition, your spouse/state-registered domestic partner and eligible child(ren) must not be home or hospital confined or receiving or applying to receive disability benefits from any source when their coverage becomes effective. If Actively at Work requirements are met, coverage will become effective on the first of the month following the receipt of your completed application for all requests that do not require additional medical information. A request for your amount that requires additional medical information and is not approved by the date listed above will not be effective until the first of the month following the date MetLife approved the coverage or increase if you meet Actively at Work requirements on that date, or the date that Actively at Work requirements are met after MetLife has approved the coverage or increase. The coverage for your spouse/state-registered domestic partner and eligible child(ren) will take effect on the date they are no longer confined, receiving or applying for disability benefits from any source or hospitalized. Who Can Be a Designated Beneficiary? You can select any beneficiary other than your employer for your Basic and Supplemental coverages, and you may change your beneficiary at any time. You can also designate more than one beneficiary. You are the beneficiary for your Dependent coverage. You can name beneficiaries online using the MyBenefits website at mybenefits.metlife.com/wapebb or by calling 866-548-7139. Monthly Costs* for Supplemental Term Life Insurance Cost is based on the amount of coverage you elect, your age as of December 31 of the prior year, and your smoking status. Spouse or state- registered domestic partner coverage is based on your age as of December 31 of the prior year as well as your spouse’s or state-registered domestic partner’s smoking status. The rates shown are the monthly cost per $1,000 of coverage. The monthly cost for dependent children covers all eligible children. Monthly Cost Per $1,000 of Employee Monthly Cost Per $1,000 of Spouse/State- Age Coverage Registered Domestic Partner Coverage Tobacco User* Non-Tobacco User Tobacco User* Non-Tobacco User Under 25 $0.039 $0.030 $0.039 $0.030 25 – 29 $0.046 $0.033 $0.046 $0.033 30 – 34 $0.060 $0.036 $0.060 $0.036 35 – 39 $0.069 $0.045 $0.069 $0.045 40 – 44 $0.077 $0.067 $0.077 $0.067 45 – 49 $0.117 $0.097 $0.117 $0.097 50 – 54 $0.179 $0.151 $0.179 $0.151 55 – 59 $0.334 $0.282 $0.334 $0.282 60 – 64 $0.508 $0.432 $0.508 $0.432 65 – 69 $0.978 $0.798 $0.978 $0.798 70 + $1.589 $1.190 $1.589 $1.190 † $0.124 Cost for your Child(ren) † Covers all eligible children * A tobacco user is anyone who has smoked cigarettes, pipes, cigars or used any tobacco in any form in the past 2 months. **Note: rates are subject to the policy’s right to change premium rates, and the employer’s right to change employee contributions.

Plan summary Page 2 Page 4

Plan summary Page 2 Page 4