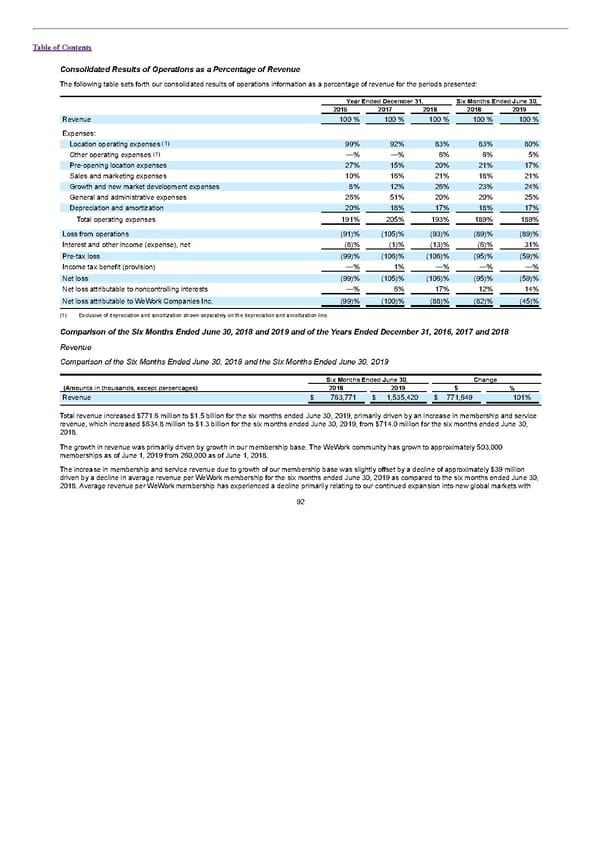

Table of Contents Consolidated Results of Operations as a Percentage of Revenue The following table sets forth our consolidated results of operations information as a percentage of revenue for the periods presented: Year Ended December 31, Six Months Ended June 30, 2016 2017 2018 2018 2019 Revenue 100 % 100 % 100 % 100 % 100 % Expenses: (1) Location operating expenses 99% 92% 83% 83% 80% (1) Other operating expenses —% —% 6% 6% 5% Pre-opening location expenses 27% 15% 20% 21% 17% Sales and marketing expenses 10% 16% 21% 18% 21% Growth and new market development expenses 8% 12% 26% 23% 24% General and administrative expenses 26% 51% 20% 20% 25% Depreciation and amortization 20% 18% 17% 18% 17% Total operating expenses 191% 205% 193% 189% 189% Loss from operations (91)% (105)% (93)% (89)% (89)% Interest and other income (expense), net (8)% (1)% (13)% (6)% 31% Pre-tax loss (99)% (106)% (106)% (95)% (59)% Income tax benefit (provision) —% 1% —% —% —% Net loss (99)% (105)% (106)% (95)% (59)% Net loss attributable to noncontrolling interests —% 6% 17% 12% 14% Net loss attributable to WeWork Companies Inc. (99)% (100)% (88)% (82)% (45)% (1) Exclusive of depreciation and amortization shown separately on the depreciation and amortization line. Comparison of the Six Months Ended June 30, 2018 and 2019 and of the Years Ended December 31, 2016, 2017 and 2018 Revenue Comparison of the Six Months Ended June 30, 2018 and the Six Months Ended June 30, 2019 Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % Revenue $ 763,771 $ 1,535,420 $ 771,649 101% Total revenue increased $771.6 million to $1.5 billion for the six months ended June 30, 2019, primarily driven by an increase in membership and service revenue, which increased $634.8 million to $1.3 billion for the six months ended June 30, 2019, from $714.0 million for the six months ended June 30, 2018. The growth in revenue was primarily driven by growth in our membership base. The WeWork community has grown to approximately 503,000 memberships as of June 1, 2019 from 260,000 as of June 1, 2018. The increase in membership and service revenue due to growth of our membership base was slightly offset by a decline of approximately $39 million driven by a decline in average revenue per WeWork membership for the six months ended June 30, 2019 as compared to the six months ended June 30, 2018. Average revenue per WeWork membership has experienced a decline primarily relating to our continued expansion into new global markets with 92

S1 - WeWork Prospectus Page 96 Page 98

S1 - WeWork Prospectus Page 96 Page 98