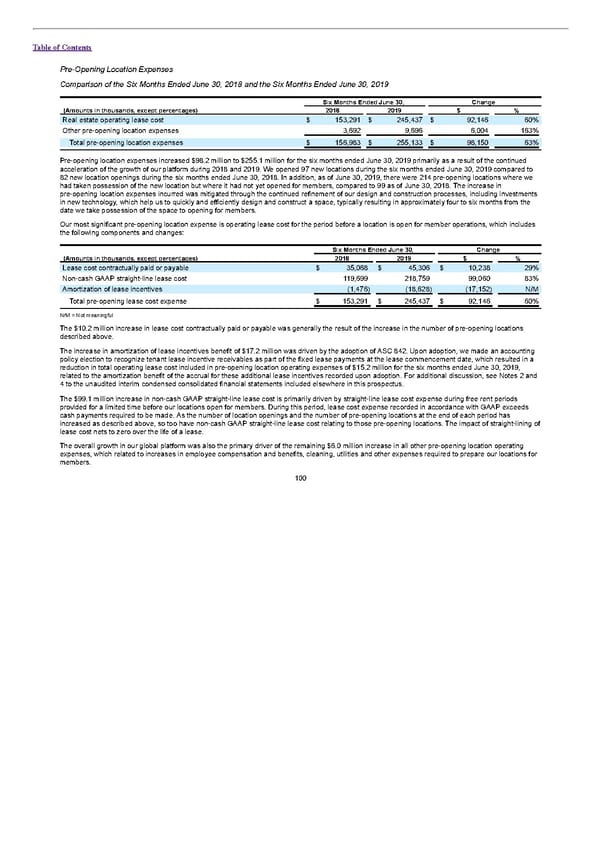

Table of Contents Pre-Opening Location Expenses Comparison of the Six Months Ended June 30, 2018 and the Six Months Ended June 30, 2019 Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % Real estate operating lease cost $ 153,291 $ 245,437 $ 92,146 60% Other pre-opening location expenses 3,692 9,696 6,004 163% Total pre-opening location expenses $ 156,983 $ 255,133 $ 98,150 63% Pre-opening location expenses increased $98.2 million to $255.1 million for the six months ended June 30, 2019 primarily as a result of the continued acceleration of the growth of our platform during 2018 and 2019. We opened 97 new locations during the six months ended June 30, 2019 compared to 82 new location openings during the six months ended June 30, 2018. In addition, as of June 30, 2019, there were 214 pre-opening locations where we had taken possession of the new location but where it had not yet opened for members, compared to 99 as of June 30, 2018. The increase in pre-opening location expenses incurred was mitigated through the continued refinement of our design and construction processes, including investments in new technology, which help us to quickly and efficiently design and construct a space, typically resulting in approximately four to six months from the date we take possession of the space to opening for members. Our most significant pre-opening location expense is operating lease cost for the period before a location is open for member operations, which includes the following components and changes: Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % Lease cost contractually paid or payable $ 35,068 $ 45,306 $ 10,238 29% Non-cash GAAP straight-line lease cost 119,699 218,759 99,060 83% Amortization of lease incentives (1,476) (18,628) (17,152) N/M Total pre-opening lease cost expense $ 153,291 $ 245,437 $ 92,146 60% N/M = Not meaningful The $10.2 million increase in lease cost contractually paid or payable was generally the result of the increase in the number of pre-opening locations described above. The increase in amortization of lease incentives benefit of $17.2 million was driven by the adoption of ASC 842. Upon adoption, we made an accounting policy election to recognize tenant lease incentive receivables as part of the fixed lease payments at the lease commencement date, which resulted in a reduction in total operating lease cost included in pre-opening location operating expenses of $15.2 million for the six months ended June 30, 2019, related to the amortization benefit of the accrual for these additional lease incentives recorded upon adoption. For additional discussion, see Notes 2 and 4 to the unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. The $99.1 million increase in non-cash GAAP straight-line lease cost is primarily driven by straight-line lease cost expense during free rent periods provided for a limited time before our locations open for members. During this period, lease cost expense recorded in accordance with GAAP exceeds cash payments required to be made. As the number of location openings and the number of pre-opening locations at the end of each period has increased as described above, so too have non-cash GAAP straight-line lease cost relating to those pre-opening locations. The impact of straight-lining of lease cost nets to zero over the life of a lease. The overall growth in our global platform was also the primary driver of the remaining $6.0 million increase in all other pre-opening location operating expenses, which related to increases in employee compensation and benefits, cleaning, utilities and other expenses required to prepare our locations for members. 100

S1 - WeWork Prospectus Page 104 Page 106

S1 - WeWork Prospectus Page 104 Page 106