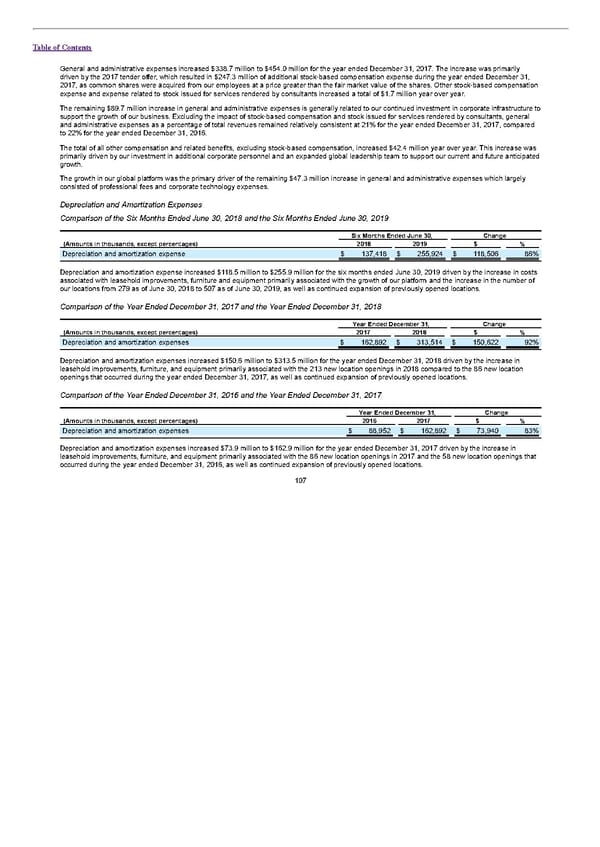

Table of Contents General and administrative expenses increased $338.7 million to $454.0 million for the year ended December 31, 2017. The increase was primarily driven by the 2017 tender offer, which resulted in $247.3 million of additional stock-based compensation expense during the year ended December 31, 2017, as common shares were acquired from our employees at a price greater than the fair market value of the shares. Other stock-based compensation expense and expense related to stock issued for services rendered by consultants increased a total of $1.7 million year over year. The remaining $89.7 million increase in general and administrative expenses is generally related to our continued investment in corporate infrastructure to support the growth of our business. Excluding the impact of stock-based compensation and stock issued for services rendered by consultants, general and administrative expenses as a percentage of total revenues remained relatively consistent at 21% for the year ended December 31, 2017, compared to 22% for the year ended December 31, 2016. The total of all other compensation and related benefits, excluding stock-based compensation, increased $42.4 million year over year. This increase was primarily driven by our investment in additional corporate personnel and an expanded global leadership team to support our current and future anticipated growth. The growth in our global platform was the primary driver of the remaining $47.3 million increase in general and administrative expenses which largely consisted of professional fees and corporate technology expenses. Depreciation and Amortization Expenses Comparison of the Six Months Ended June 30, 2018 and the Six Months Ended June 30, 2019 Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % Depreciation and amortization expense $ 137,418 $ 255,924 $ 118,506 86% Depreciation and amortization expense increased $118.5 million to $255.9 million for the six months ended June 30, 2019 driven by the increase in costs associated with leasehold improvements, furniture and equipment primarily associated with the growth of our platform and the increase in the number of our locations from 279 as of June 30, 2018 to 507 as of June 30, 2019, as well as continued expansion of previously opened locations. Comparison of the Year Ended December 31, 2017 and the Year Ended December 31, 2018 Year Ended December 31, Change (Amounts in thousands, except percentages) 2017 2018 $ % Depreciation and amortization expenses $ 162,892 $ 313,514 $ 150,622 92% Depreciation and amortization expenses increased $150.6 million to $313.5 million for the year ended December 31, 2018 driven by the increase in leasehold improvements, furniture, and equipment primarily associated with the 213 new location openings in 2018 compared to the 86 new location openings that occurred during the year ended December 31, 2017, as well as continued expansion of previously opened locations. Comparison of the Year Ended December 31, 2016 and the Year Ended December 31, 2017 Year Ended December 31, Change (Amounts in thousands, except percentages) 2016 2017 $ % Depreciation and amortization expenses $ 88,952 $ 162,892 $ 73,940 83% Depreciation and amortization expenses increased $73.9 million to $162.9 million for the year ended December 31, 2017 driven by the increase in leasehold improvements, furniture, and equipment primarily associated with the 86 new location openings in 2017 and the 58 new location openings that occurred during the year ended December 31, 2016, as well as continued expansion of previously opened locations. 107

S1 - WeWork Prospectus Page 111 Page 113

S1 - WeWork Prospectus Page 111 Page 113