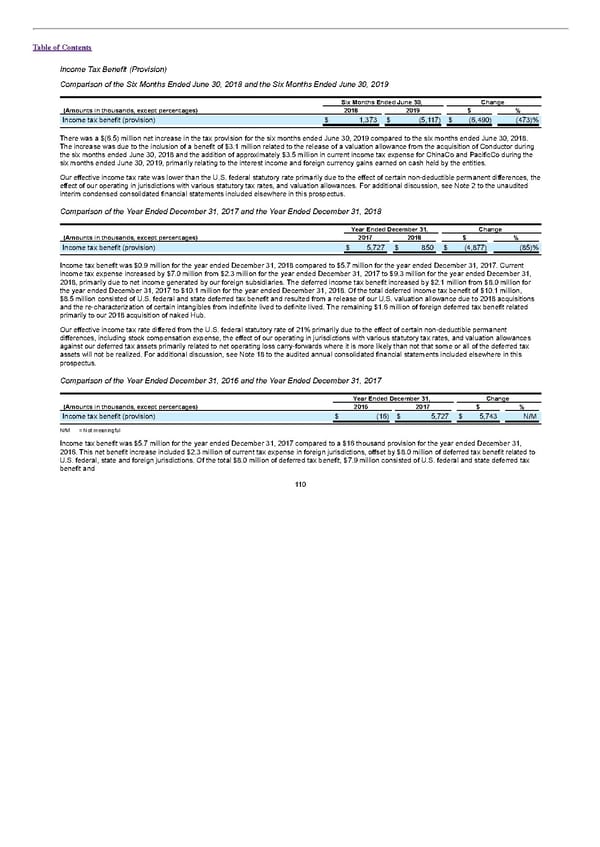

Table of Contents Income Tax Benefit (Provision) Comparison of the Six Months Ended June 30, 2018 and the Six Months Ended June 30, 2019 Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % Income tax benefit (provision) $ 1,373 $ (5,117) $ (6,490) (473)% There was a $(6.5) million net increase in the tax provision for the six months ended June 30, 2019 compared to the six months ended June 30, 2018. The increase was due to the inclusion of a benefit of $3.1 million related to the release of a valuation allowance from the acquisition of Conductor during the six months ended June 30, 2018 and the addition of approximately $3.5 million in current income tax expense for ChinaCo and PacificCo during the six months ended June 30, 2019, primarily relating to the interest income and foreign currency gains earned on cash held by the entities. Our effective income tax rate was lower than the U.S. federal statutory rate primarily due to the effect of certain non-deductible permanent differences, the effect of our operating in jurisdictions with various statutory tax rates, and valuation allowances. For additional discussion, see Note 2 to the unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. Comparison of the Year Ended December 31, 2017 and the Year Ended December 31, 2018 Year Ended December 31, Change (Amounts in thousands, except percentages) 2017 2018 $ % Income tax benefit (provision) $ 5,727 $ 850 $ (4,877) (85)% Income tax benefit was $0.9 million for the year ended December 31, 2018 compared to $5.7 million for the year ended December 31, 2017. Current income tax expense increased by $7.0 million from $2.3 million for the year ended December 31, 2017 to $9.3 million for the year ended December 31, 2018, primarily due to net income generated by our foreign subsidiaries. The deferred income tax benefit increased by $2.1 million from $8.0 million for the year ended December 31, 2017 to $10.1 million for the year ended December 31, 2018. Of the total deferred income tax benefit of $10.1 million, $8.5 million consisted of U.S. federal and state deferred tax benefit and resulted from a release of our U.S. valuation allowance due to 2018 acquisitions and the re-characterization of certain intangibles from indefinite lived to definite lived. The remaining $1.6 million of foreign deferred tax benefit related primarily to our 2018 acquisition of naked Hub. Our effective income tax rate differed from the U.S. federal statutory rate of 21% primarily due to the effect of certain non-deductible permanent differences, including stock compensation expense, the effect of our operating in jurisdictions with various statutory tax rates, and valuation allowances against our deferred tax assets primarily related to net operating loss carry-forwards where it is more likely than not that some or all of the deferred tax assets will not be realized. For additional discussion, see Note 18 to the audited annual consolidated financial statements included elsewhere in this prospectus. Comparison of the Year Ended December 31, 2016 and the Year Ended December 31, 2017 Year Ended December 31, Change (Amounts in thousands, except percentages) 2016 2017 $ % Income tax benefit (provision) $ (16) $ 5,727 $ 5,743 N/M N/M = Not meaningful Income tax benefit was $5.7 million for the year ended December 31, 2017 compared to a $16 thousand provision for the year ended December 31, 2016. This net benefit increase included $2.3 million of current tax expense in foreign jurisdictions, offset by $8.0 million of deferred tax benefit related to U.S. federal, state and foreign jurisdictions. Of the total $8.0 million of deferred tax benefit, $7.9 million consisted of U.S. federal and state deferred tax benefit and 110

S1 - WeWork Prospectus Page 114 Page 116

S1 - WeWork Prospectus Page 114 Page 116