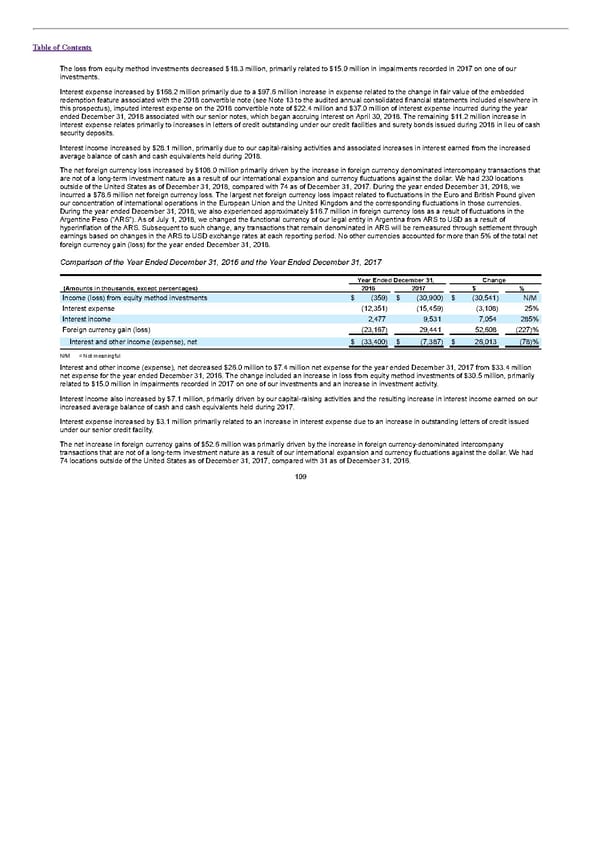

Table of Contents The loss from equity method investments decreased $18.3 million, primarily related to $15.0 million in impairments recorded in 2017 on one of our investments. Interest expense increased by $168.2 million primarily due to a $97.6 million increase in expense related to the change in fair value of the embedded redemption feature associated with the 2018 convertible note (see Note 13 to the audited annual consolidated financial statements included elsewhere in this prospectus), imputed interest expense on the 2018 convertible note of $22.4 million and $37.0 million of interest expense incurred during the year ended December 31, 2018 associated with our senior notes, which began accruing interest on April 30, 2018. The remaining $11.2 million increase in interest expense relates primarily to increases in letters of credit outstanding under our credit facilities and surety bonds issued during 2018 in lieu of cash security deposits. Interest income increased by $28.1 million, primarily due to our capital-raising activities and associated increases in interest earned from the increased average balance of cash and cash equivalents held during 2018. The net foreign currency loss increased by $108.0 million primarily driven by the increase in foreign currency denominated intercompany transactions that are not of a long-term investment nature as a result of our international expansion and currency fluctuations against the dollar. We had 230 locations outside of the United States as of December 31, 2018, compared with 74 as of December 31, 2017. During the year ended December 31, 2018, we incurred a $78.6 million net foreign currency loss. The largest net foreign currency loss impact related to fluctuations in the Euro and British Pound given our concentration of international operations in the European Union and the United Kingdom and the corresponding fluctuations in those currencies. During the year ended December 31, 2018, we also experienced approximately $16.7 million in foreign currency loss as a result of fluctuations in the Argentine Peso (“ARS”). As of July 1, 2018, we changed the functional currency of our legal entity in Argentina from ARS to USD as a result of hyperinflation of the ARS. Subsequent to such change, any transactions that remain denominated in ARS will be remeasured through settlement through earnings based on changes in the ARS to USD exchange rates at each reporting period. No other currencies accounted for more than 5% of the total net foreign currency gain (loss) for the year ended December 31, 2018. Comparison of the Year Ended December 31, 2016 and the Year Ended December 31, 2017 Year Ended December 31, Change (Amounts in thousands, except percentages) 2016 2017 $ % Income (loss) from equity method investments $ (359) $ (30,900) $ (30,541) N/M Interest expense (12,351) (15,459) (3,108) 25% Interest income 2,477 9,531 7,054 285% Foreign currency gain (loss) (23,167) 29,441 52,608 (227)% Interest and other income (expense), net $ (33,400) $ (7,387) $ 26,013 (78)% N/M = Not meaningful Interest and other income (expense), net decreased $26.0 million to $7.4 million net expense for the year ended December 31, 2017 from $33.4 million net expense for the year ended December 31, 2016. The change included an increase in loss from equity method investments of $30.5 million, primarily related to $15.0 million in impairments recorded in 2017 on one of our investments and an increase in investment activity. Interest income also increased by $7.1 million, primarily driven by our capital-raising activities and the resulting increase in interest income earned on our increased average balance of cash and cash equivalents held during 2017. Interest expense increased by $3.1 million primarily related to an increase in interest expense due to an increase in outstanding letters of credit issued under our senior credit facility. The net increase in foreign currency gains of $52.6 million was primarily driven by the increase in foreign currency-denominated intercompany transactions that are not of a long-term investment nature as a result of our international expansion and currency fluctuations against the dollar. We had 74 locations outside of the United States as of December 31, 2017, compared with 31 as of December 31, 2016. 109

S1 - WeWork Prospectus Page 113 Page 115

S1 - WeWork Prospectus Page 113 Page 115