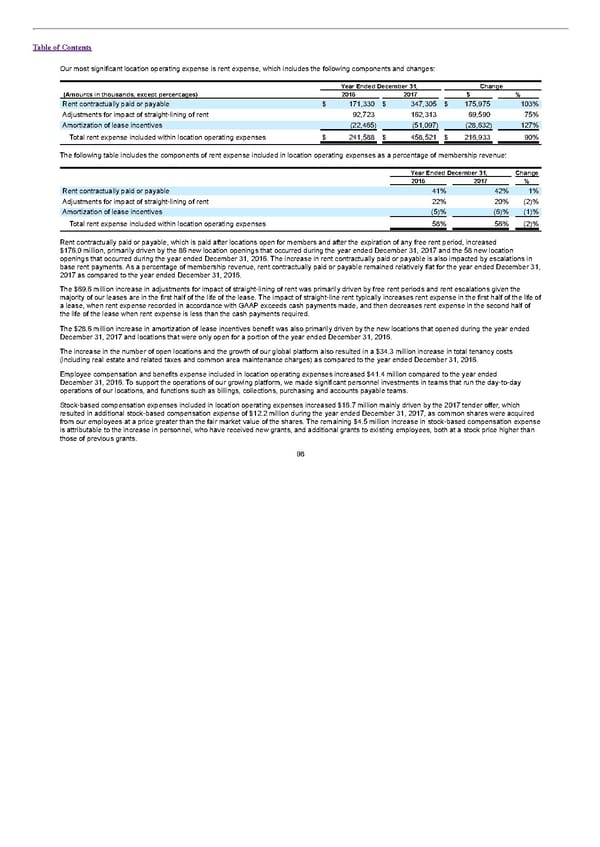

Table of Contents Our most significant location operating expense is rent expense, which includes the following components and changes: Year Ended December 31, Change (Amounts in thousands, except percentages) 2016 2017 $ % Rent contractually paid or payable $ 171,330 $ 347,305 $ 175,975 103% Adjustments for impact of straight-lining of rent 92,723 162,313 69,590 75% Amortization of lease incentives (22,465) (51,097) (28,632) 127% Total rent expense included within location operating expenses $ 241,588 $ 458,521 $ 216,933 90% The following table includes the components of rent expense included in location operating expenses as a percentage of membership revenue: Year Ended December 31, Change 2016 2017 % Rent contractually paid or payable 41% 42% 1% Adjustments for impact of straight-lining of rent 22% 20% (2)% Amortization of lease incentives (5)% (6)% (1)% Total rent expense included within location operating expenses 58% 56% (2)% Rent contractually paid or payable, which is paid after locations open for members and after the expiration of any free rent period, increased $176.0 million, primarily driven by the 86 new location openings that occurred during the year ended December 31, 2017 and the 58 new location openings that occurred during the year ended December 31, 2016. The increase in rent contractually paid or payable is also impacted by escalations in base rent payments. As a percentage of membership revenue, rent contractually paid or payable remained relatively flat for the year ended December 31, 2017 as compared to the year ended December 31, 2016. The $69.6 million increase in adjustments for impact of straight-lining of rent was primarily driven by free rent periods and rent escalations given the majority of our leases are in the first half of the life of the lease. The impact of straight-line rent typically increases rent expense in the first half of the life of a lease, when rent expense recorded in accordance with GAAP exceeds cash payments made, and then decreases rent expense in the second half of the life of the lease when rent expense is less than the cash payments required. The $28.6 million increase in amortization of lease incentives benefit was also primarily driven by the new locations that opened during the year ended December 31, 2017 and locations that were only open for a portion of the year ended December 31, 2016. The increase in the number of open locations and the growth of our global platform also resulted in a $34.3 million increase in total tenancy costs (including real estate and related taxes and common area maintenance charges) as compared to the year ended December 31, 2016. Employee compensation and benefits expense included in location operating expenses increased $41.4 million compared to the year ended December 31, 2016. To support the operations of our growing platform, we made significant personnel investments in teams that run the day-to-day operations of our locations, and functions such as billings, collections, purchasing and accounts payable teams. Stock-based compensation expenses included in location operating expenses increased $16.7 million mainly driven by the 2017 tender offer, which resulted in additional stock-based compensation expense of $12.2 million during the year ended December 31, 2017, as common shares were acquired from our employees at a price greater than the fair market value of the shares. The remaining $4.5 million increase in stock-based compensation expense is attributable to the increase in personnel, who have received new grants, and additional grants to existing employees, both at a stock price higher than those of previous grants. 98

S1 - WeWork Prospectus Page 102 Page 104

S1 - WeWork Prospectus Page 102 Page 104