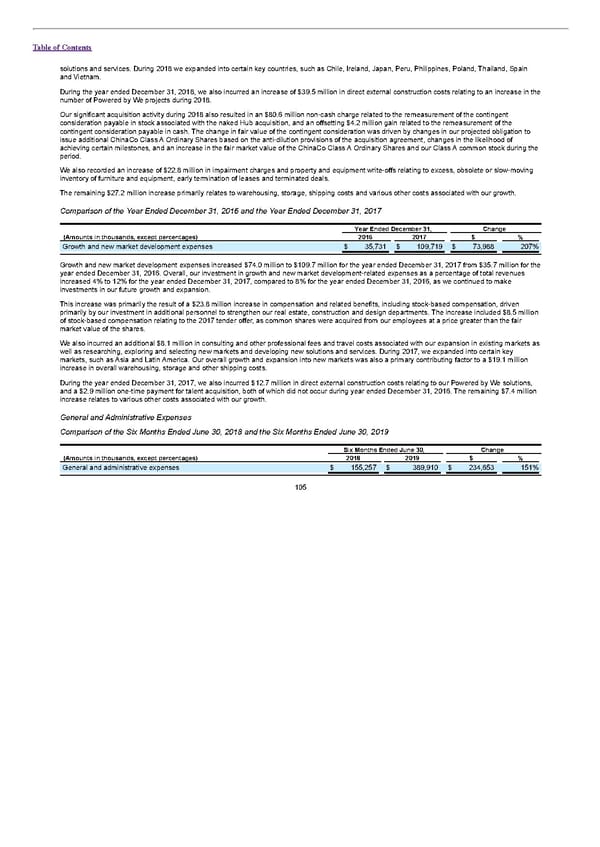

Table of Contents solutions and services. During 2018 we expanded into certain key countries, such as Chile, Ireland, Japan, Peru, Philippines, Poland, Thailand, Spain and Vietnam. During the year ended December 31, 2018, we also incurred an increase of $39.5 million in direct external construction costs relating to an increase in the number of Powered by We projects during 2018. Our significant acquisition activity during 2018 also resulted in an $80.6 million non-cash charge related to the remeasurement of the contingent consideration payable in stock associated with the naked Hub acquisition, and an offsetting $4.2 million gain related to the remeasurement of the contingent consideration payable in cash. The change in fair value of the contingent consideration was driven by changes in our projected obligation to issue additional ChinaCo Class A Ordinary Shares based on the anti-dilution provisions of the acquisition agreement, changes in the likelihood of achieving certain milestones, and an increase in the fair market value of the ChinaCo Class A Ordinary Shares and our Class A common stock during the period. We also recorded an increase of $22.8 million in impairment charges and property and equipment write-offs relating to excess, obsolete or slow-moving inventory of furniture and equipment, early termination of leases and terminated deals. The remaining $27.2 million increase primarily relates to warehousing, storage, shipping costs and various other costs associated with our growth. Comparison of the Year Ended December 31, 2016 and the Year Ended December 31, 2017 Year Ended December 31, Change (Amounts in thousands, except percentages) 2016 2017 $ % Growth and new market development expenses $ 35,731 $ 109,719 $ 73,988 207% Growth and new market development expenses increased $74.0 million to $109.7 million for the year ended December 31, 2017 from $35.7 million for the year ended December 31, 2016. Overall, our investment in growth and new market development-related expenses as a percentage of total revenues increased 4% to 12% for the year ended December 31, 2017, compared to 8% for the year ended December 31, 2016, as we continued to make investments in our future growth and expansion. This increase was primarily the result of a $23.8 million increase in compensation and related benefits, including stock-based compensation, driven primarily by our investment in additional personnel to strengthen our real estate, construction and design departments. The increase included $8.5 million of stock-based compensation relating to the 2017 tender offer, as common shares were acquired from our employees at a price greater than the fair market value of the shares. We also incurred an additional $8.1 million in consulting and other professional fees and travel costs associated with our expansion in existing markets as well as researching, exploring and selecting new markets and developing new solutions and services. During 2017, we expanded into certain key markets, such as Asia and Latin America. Our overall growth and expansion into new markets was also a primary contributing factor to a $19.1 million increase in overall warehousing, storage and other shipping costs. During the year ended December 31, 2017, we also incurred $12.7 million in direct external construction costs relating to our Powered by We solutions, and a $2.9 million one-time payment for talent acquisition, both of which did not occur during year ended December 31, 2016. The remaining $7.4 million increase relates to various other costs associated with our growth. General and Administrative Expenses Comparison of the Six Months Ended June 30, 2018 and the Six Months Ended June 30, 2019 Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % General and administrative expenses $ 155,257 $ 389,910 $ 234,653 151% 105

S1 - WeWork Prospectus Page 109 Page 111

S1 - WeWork Prospectus Page 109 Page 111